New wastewater infrastructure to cater for a growing SEQ

Rethinking the NPSH matrix

New wastewater infrastructure to cater for a growing SEQ

Rethinking the NPSH matrix

2022 anticipating better times ahead

Climate

population growth, and water scarcity are creating new challenges, and desalination is becoming an important alternative to traditional freshwater resources.

Hello all and welcome to the Summer Edition of Pump Industry Magazine. On Wednesday 10 November, PIA held its 18th AGM via a Zoom meeting hosted once again by Laura Harvey, Managing Editor at Monkey Media. As you know, Monkey Media is the publisher of the PIA’s official magazine. Hopefully as Laura said we will be able to meet face to face in 2022, but as I stated in my President’s address, we cannot say the end is in sight and as I write this editorial, we are learning of yet another variant – Omicron – which has been found around the world and in Australia; the level of severity of the new variant will take some weeks to determine.

Drainage Act 2018 (PD Act 2018). The QBCC petitioned the Services Trade Council (STC), an instrument of the QBCC, on our behalf. The matter was tabled with the STC on 6 October where it remains; we understand the matter remains under consideration and we await a formal response.

Pump Industry Australia Incorporated C/-340, Stuarts Point Road

Yarrahapinni NSW 2441 Australia Ph/Fax: (02) 6569 0160 pumpsaustralia@bigpond.com www.pumps.org.au

PIA Executive Council 2022

John Inkster - President Brown Brothers Engineers

James Blannin - Vice President Stevco Pumps & Seals

Kevin Wilson - Treasurer/Secretary Executive Officer

Alan Rowan - Councillor Executive Officer - Publications and Training, Life Member

Ken Kugler Executive Officer - Standards, Life Member

Michael Woolley - Councillor Tsurumi Australia

Geoff Harvey - Councillor Irrigation Australia Limited

Billie Tan - Councillor Regent Pumps

Steve Bosner - Councillor Pioneer Pumps

Joel Neideck - Councillor TDA Pumps

Matt Arnett - Councillor Ebara Pumps Australia

Jamie Oliver - Councillor Grundfos Pumps

We had 56 registrations at the AGM, representing some 40 member organisations, so a pleasing turnout; this reflects the growing Membership of PIA which now stands at over 90. A highlight of the AGM was guest speaker Jason Cunningham, accountant and owner of business advisory firm The Practice. Jason is a born entertainer and enjoys sharing his business insights and experience with fellow owners looking to grow their business. His theme for the night was “Beginning with the end in mind – Build a business ready for sale”. Jason has both an engaging and energising manner which enables him to communicate in a way everyone can relate to. We received many positive comments about his presentation.

At our AGM, James Blannin was reelected VP, Kevin Wilson was re-elected as Secretary/Treasurer. Our Standards Officer Ken Kugler was re-elected, as was Alan Rowan our Publications and Training Officer. All other Councillors were re-elected except for Anant Yuvarajah who did not stand for re-election. I take this opportunity to thank Anant for his contribution to Council and at the same time welcome Jamie Oliver from Grundfos Pumps. We welcome Grundfos Pumps back into the PIA as it is important to have a good cross section of industry representing all our Members.

So, what were the highlights of 2021; unfortunately COVID greatly restricted face-to-face activities, but we were able to hold the second of our Pumps & Systems Training Course in Melbourne in March and then a very well-attended meeting in Perth in April hosted by Tsurumi Australia. After that, COVID regulations and the uncertainty of border closures hindered any further attempts.

During the year we initiated dialogue with the Queensland Building and Construction Commission (QBCC) on behalf of those Members who conduct work covered by the Plumbing and

Meanwhile, we have learnt that the Department of Energy and Public Works, on behalf of the QLD Government, will be carrying out an independent review of the QBCC governance arrangements. The review will look at the QBCC’s structure, governance arrangements, roles and responsibilities, providing recommendations about legislative or administrative changes that might improve operations of the QBCC. Fire Pumps Australia (FPA) has also been notified of this.

How this might impact our discussions is unknown at the present time. This is an extremely important matter to many of our QLD Members, some of whom have experienced firsthand the QBCC regulations. To date I am not aware of any Members who have been fined for non compliance under the PD Act but I know some have been questioned. As more information comes to light, PIA will keep you informed.

In an endeavour to hold more online Seminars in 2022, Council consulted with Rob Welke of Tallemenco. Rob has been involved in pumping and hydraulics for over 50 years and is a well-known independent consultant and educator. We successfully held our first Seminar on the “Energy Efficiency of Pipelines” on 24 November, attracting 71 registrations which was great for our first effort. The Seminar was heavily subsidised by PIA as an inducement to Members to attend.

PIA is planning to run another Seminar with Rob hopefully mid-February on “Flow metering for on-site pump tests”. Malcolm Robertson of Robertson Technology in WA has also offered to do a Seminar on “Condition monitoring”, and I am sure Ron Astall would be like-minded.

As always, I extend a hand out to the larger pump organisations to participate more fully in PIA activities; we would benefit greatly from your experience and knowledge as we endeavour to act as the peak body representing all the pump industry.

I take this opportunity to thank all the Executive and Executive Officers for their assistance during the year and extend a warm welcome to Jamie Oliver in joining Council. Special thanks to our hard-working Secretary Kevin Wilson for his good work.

I wish you all a COVID-safe and prosperous 2022

John Inkster - President

Polymaster’s unique Enclosed IBC Bund solves many of the problems associated with IBC storage and chemical/fluid decanting in a weather resistant, purpose-built enclosure.

Æ Full weather protection – stops rain entering the enclosure

Æ Easy forklift loading with wide forklift access from both side and back

Æ 250ltr day tank

Æ Lockable cabinet to keep system secure

Æ Venting by two sides

Æ Viewing windows incorporated into the doors

Æ 110% bund capacity complies with AS3780

Æ Sight tube and low-level alarm available

Æ Chemical resistant – high grade polyethylene construction

Published by

ABN: 36 426 734 954

C/- The Commons, 36-38 Gipps St, Collingwood VIC 3066

P: (03) 9988 4950

F: (03) 8456 6720

monkeymedia.com.au info@monkeymedia.com.au pumpindustry.com.au magazine@pumpindustry.com.au

Editor: Lauren Cella

Contributing Editor: Michelle Goldsmith

Journalists: Annabelle Powell, Christopher Allan

Business Development Manager: Rima Munafo, Jacob Trad

Design Manager: Alejandro Molano

Designers: Jacqueline Buckmaster, Danielle Harris, Luke Martin

Publisher: Chris Bland

Managing Editor: Laura Harvey

ISSN: 2201-0270

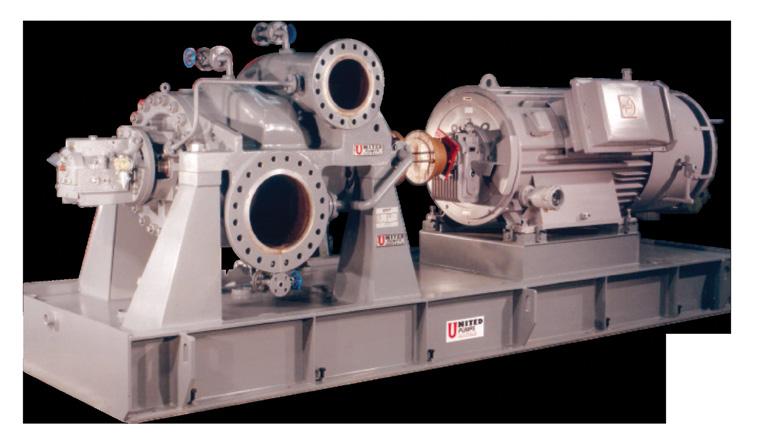

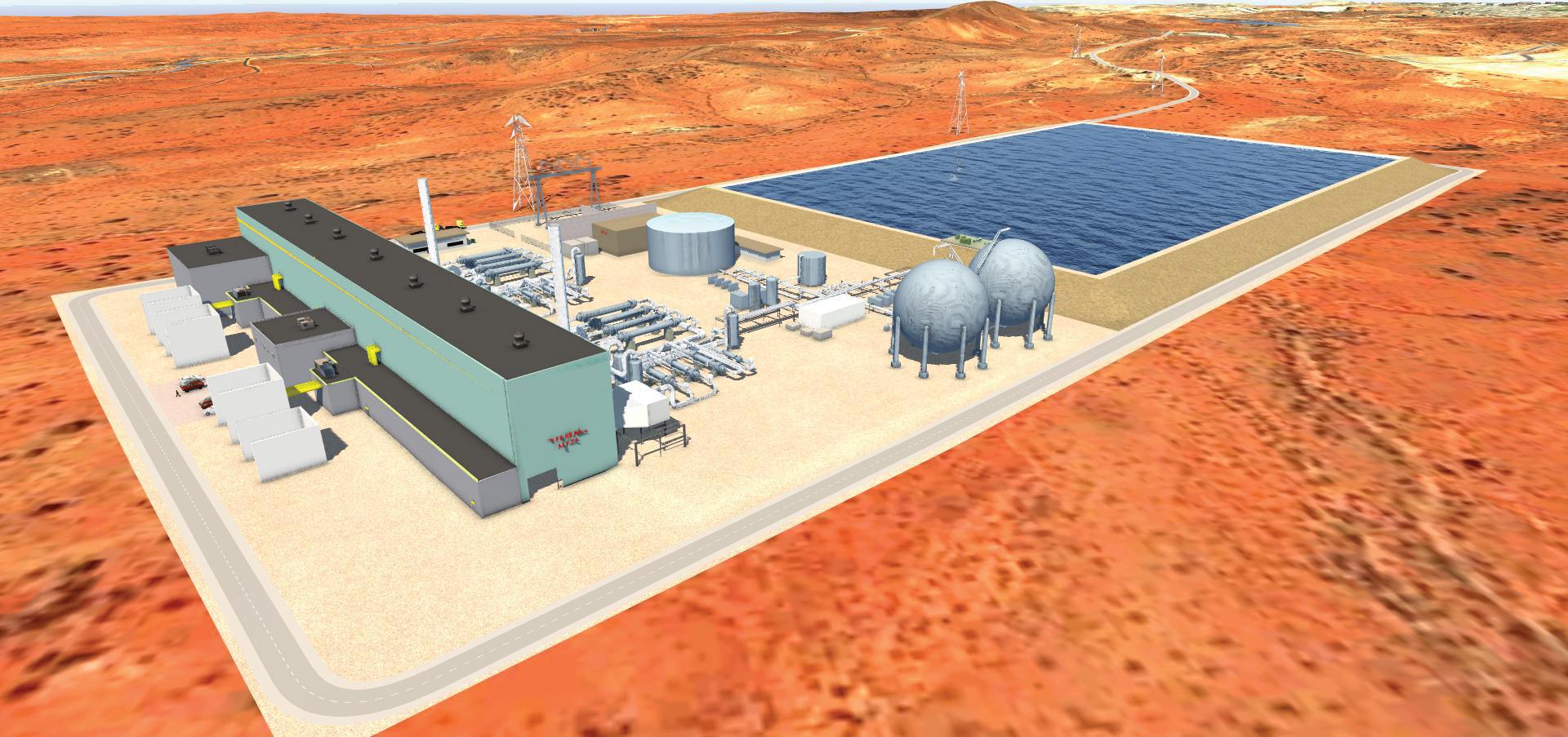

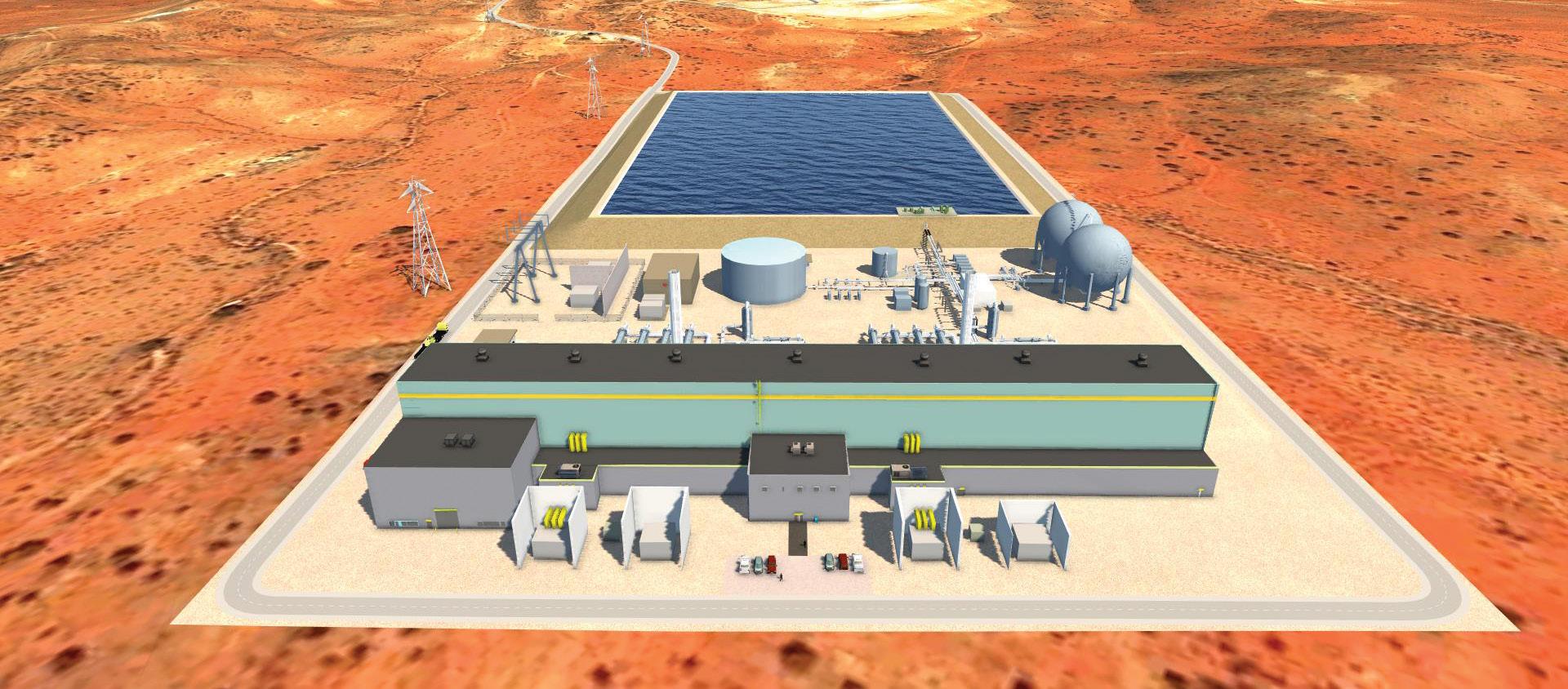

BCI Minerals Limited (BCI) has awarded a $16 million contract for a main seawater pump structure at the Mardie Salt and Potash Project, also announcing that the project’s northern embankment trial is nearly completed and construction of its southern trial pond is beginning.

The contract for the main seawater pump structure is fully funded from BCI’s existing cash balance of $110 million as of July 2021, and has been awarded to Western Australian company, Ertech’s Geomarine business.

Ertech’s Geomarine specialises in designing and constructing nearshore marine infrastructure for the resources, infrastructure and defence sectors.

When the project is fully operational, the primary seawater pump station will pump 160GL of water into the evaporation ponds each year, equivalent to approximately 70,000 Olympic swimming pools.

The Mardie Salt and Potash Project’s investigative works are an essential precursor to main construction, to provide confidence about key assumptions, including materials availability, construction methodology, pond wall settlement, pumping rates, pond floor water retention, and cost and schedule assumptions.

Construction of the northern embankment trial was nearing completion in September and the southern trial pond will incorporate construction methodology, materials and equipment learnings from the northern embankment trial.

Construction of the civil works will form part of a broader contract awarded to WBHO Infrastructure in March 2021,

which includes the northern embankment trial, southern trial pond, and after full regulatory and access approvals, Pond 1 and Pond 2.

The work involves the design, procurement, construction and commissioning of all the detailed earthworks, piling, structural steel, concrete, mechanical and electrical installations required to accommodate and operate six 3,000L per second pumps within the pump structure.

Main construction of the project can only commence when BCI has received approval from the Western Australian Minister for Environment, as well as associated secondary approvals, including when final tenure and funding have been secured.

BCI anticipated all these to be in place by late 2021.

WELCOME TO THE BIG END OF TOWN.

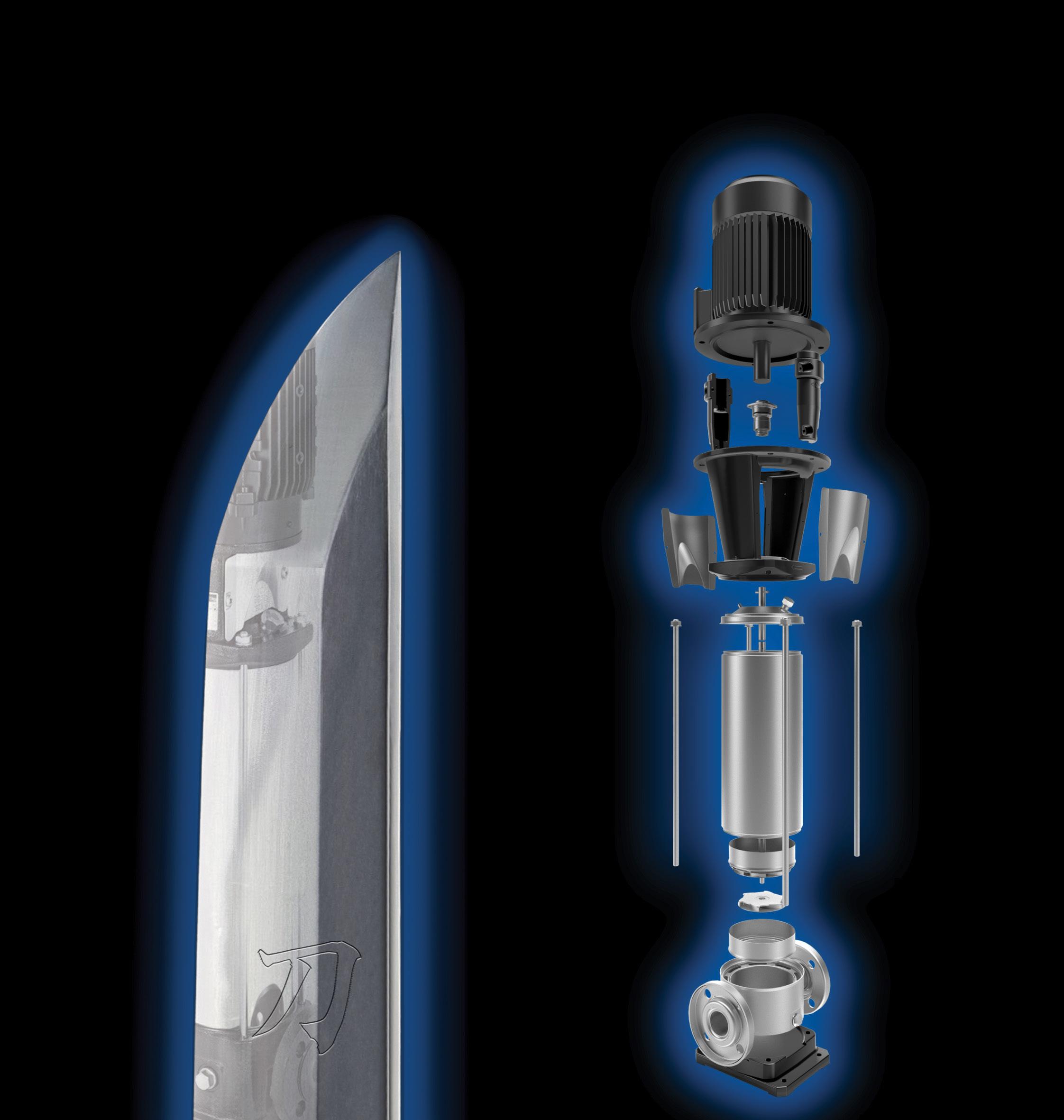

VERTICAL TURBINE PUMPS

Layne Bowler vertical turbine pumps have a proven record under the most demanding and toughest of conditions.

• Flows to 7,500 L/Sec

• Heads to 500 m

• Power to 1000+ kW

• Temperatures to 150°C

• Bowls Diameter up to 45 inch

When high head and high flows are required look no further than this quality Italian made range.

• Flows to 5000m³/h

• Head to 220m

• Pumps that exceed EN733 (DIN 24255 standard)

Designed for long life and maintenancefree service in the harshest environments. This market leading hose is tough and durable with exceptional resistance to abrasion and cutting.

A heavy reinforced fluid transfer hose made from a blend of nitrile rubber and PVC, with added UV barrier to prevent damage from UV radiation.

INTERNATIONAL DRINKING WATER CERTIFICATION

AUSTRALIA AS-NZS4020-2005 APPROVED UK WRAS APPROVAL to BS6920 USA NSF61 LISTED GERMANY KTW-DVGW APPROVED POLAND PZH APPROVED

The Tasmanian Government has launched the Preferred Option Design for the Sassafras Wesley Vale Irrigation Scheme Augmentation, which includes 95km of new and refurbished pipeline and five pump stations.

This Tranche Three irrigation project is expected to double the amount of high-surety irrigation water delivered to farmers in the productive North West Tasmanian region. It is also expected to create an estimated 120 jobs and underpin $28.3 million in on-farm investment.

The Tasmanian Government has committed $18.34 million, the Australian Government $30.57 million and landowners $13.81 million to refurbish existing infrastructure and construct additional pipelines and pump stations to increase the capacity of the scheme from 5,660 to 13,686 megalitres.

Expected to be operational for the 2025/26 irrigation season, this water will enable farmers to invest,

diversify, expand and value add, as well as provide muchneeded guarantees for crop contracts and on-farm investment leverage.

The Preferred Option Design follows a similar alignment to the existing scheme and includes 95km of new and refurbished pipeline, five pump stations and the replacement of 70 property outlets.

Water will be sourced at the Great Bend Pump Station on the Mersey River and backed up by releases from Parangana Dam.

This project is one of ten Tranche Three irrigation schemes being developed by Tasmanian Irrigation to assist the Tasmanian Government in reaching its target of increasing the farm gate value of the state’s agricultural sector to $10 billion a year by 2050.

Kelair Pumps Building & Fire Division is one of the most technically-competent suppliers in Australia. We can provide a complete range of fire sprinkler pumpsets for all applications, fully compliant to technical specificiations.

Benefits of containerised fire pump units:

- Purpose built to individual requirements

- Compact, pre-fabricated, complete packaged solution

- Simple to mobilise and transport

- Fully tested to AS2941/ISO9906 and pre-commissioned

- Wall insulation keeps operational noise to a minimum

- Turnkey installation saves time and labour costs

We know the importance of choosing the right equipment to match your process. With our extensive range of pumps, first class customer service and ongoing comprehensive support, Kelair Pumps are second to none when it comes to your pumping requirements.

Acquiring Galbraith’s gives Brown Brothers NZ access to Oceania and strengthens the fire pump position, while solidifying the Group’s market leadership.

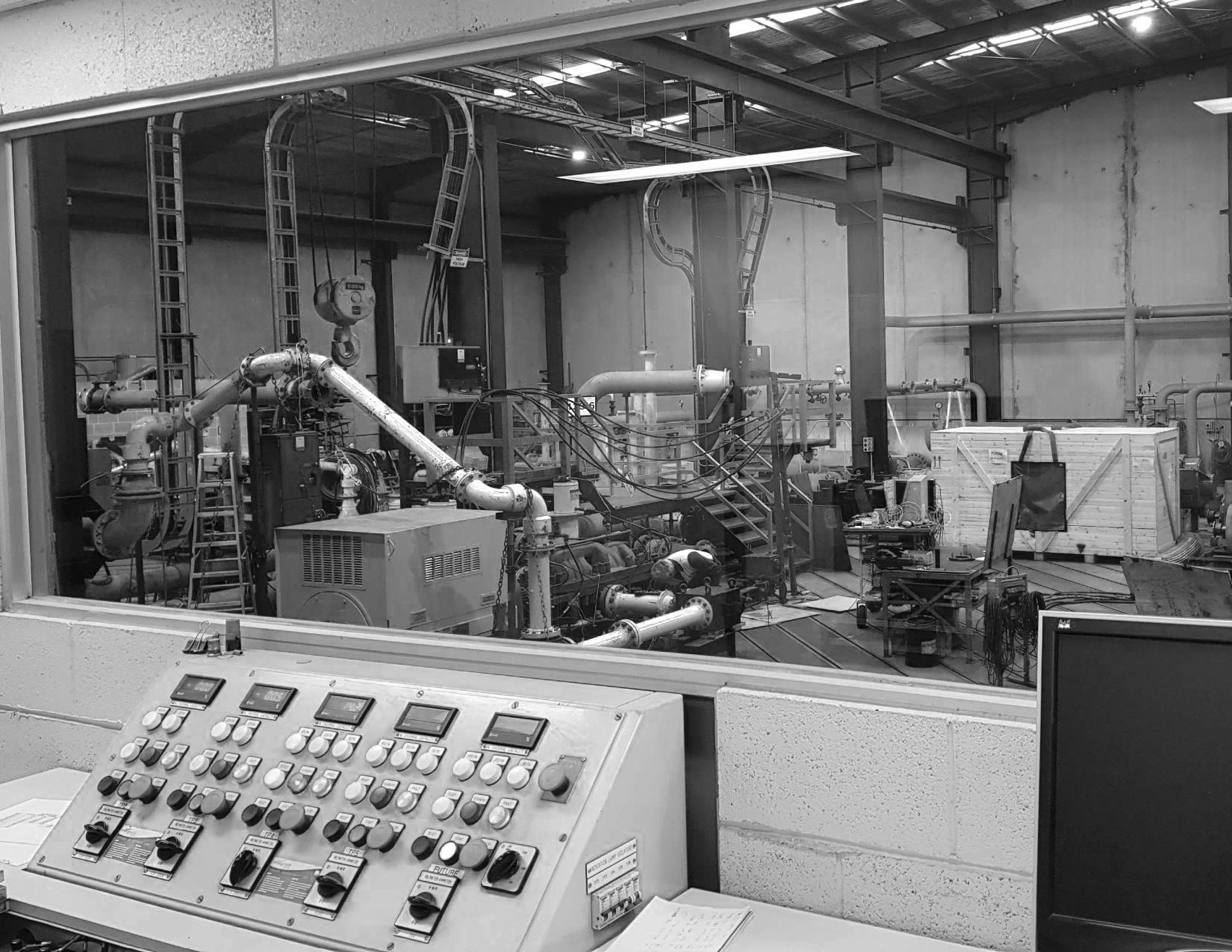

Galbraith Engineering – a family-owned business – is recognised as New Zealand’s leading fire pump specialists, designing and manufacturing diesel and electric fire pumps under the Firewater brand. In addition to this, Galbraith also builds pump sets for irrigation, snow-making and frost fighting. They also supply consultancy and system design, pump commissioning, pump performance testing, pipe fabrication, and maintenance and repair. Galbraith has 14 employees with headquarters in Christchurch and a service base in Auckland.

“We have been in the business for 28 years, and we’ve come to the point where we were looking for a strategic partner that could take us to the next level. We have known Brown Brothers New Zealand for many years now and we see them as a like-minded organisation with an eye for future growth,” said Steve Galbraith, General Manager and part-owner of Galbraith Engineers.

“There is a continuous demand for fire pumps in the commercial world of warehousing, fuel terminals, oil and gas, and a wide range of industrial sectors. Having Galbraith

Engineers in the Group will allow us to consolidate the fire business in Oceania region and partner with Kelair Pumps for high-end applications,” said John Inkster, Managing Director of Brown Brothers Engineers Group.

“As one large Group, we will be well-positioned to continuously take market shares in Oceania while strengthening our strong supplier relationships and attract the best talents.”

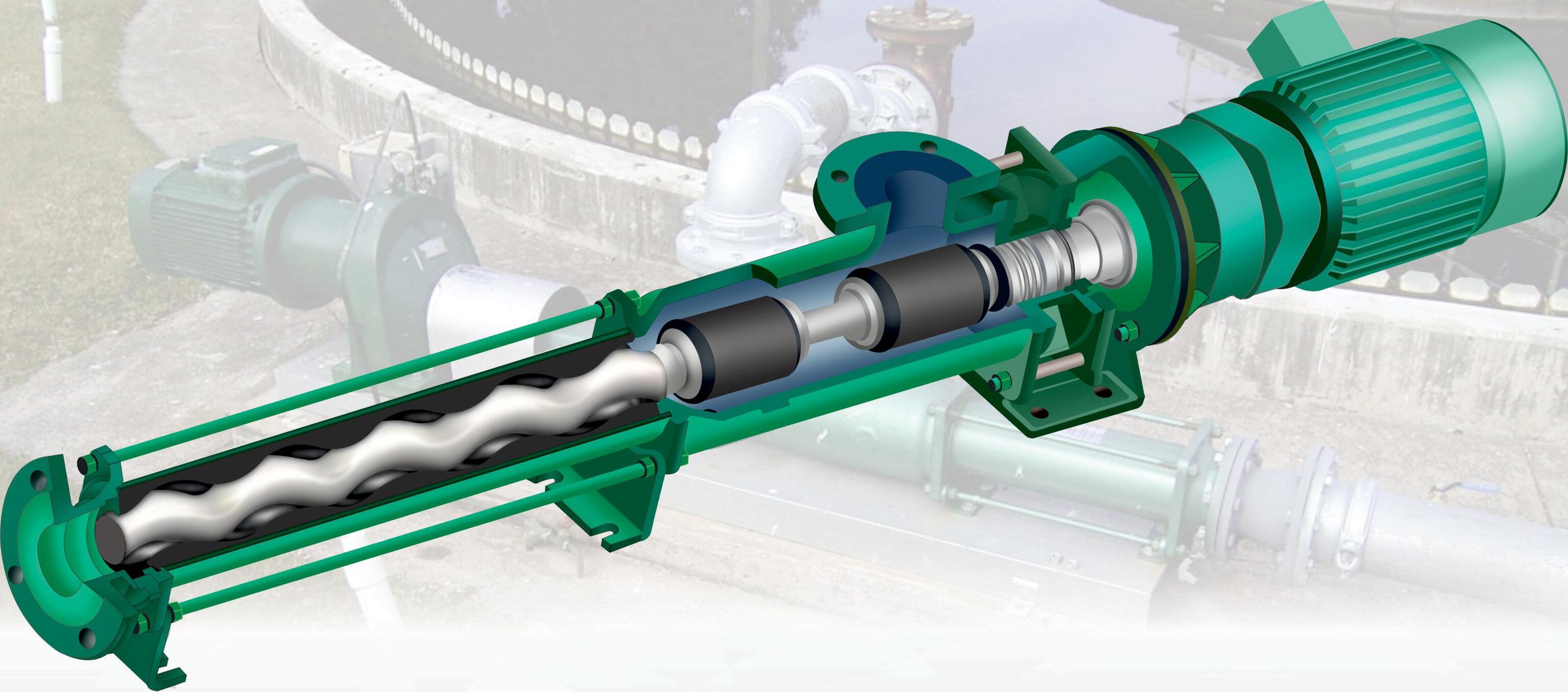

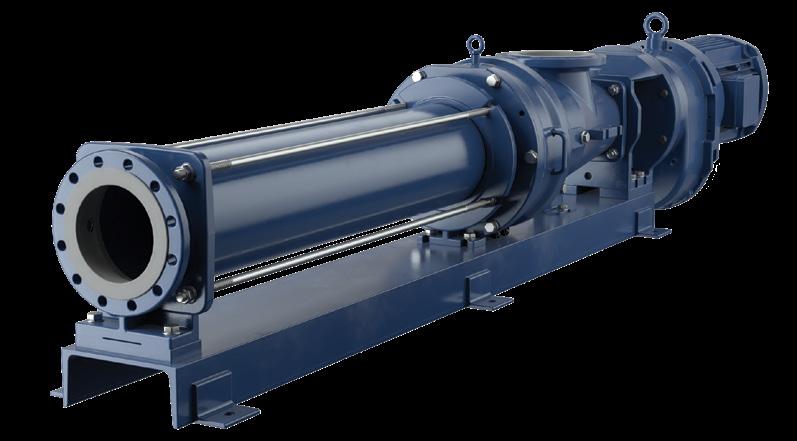

KEY APPLICATIONS Fair Pricing Policy For Pumps And Other Brand Spares Trusted Helical Rotor Pump Manufacturer For Over 20 Years In Australia

Primary, Secondary & Tertiary Clarification Process | Sludge Thickening Process | Digestion Process | Dewatering and Sludge Incineration Process | Polymer Dosing

The Townsville City Council contracted local business CivilPlus Constructions to replace two 120kg pumps that supply raw water to the Giru Water Treatment Plant, ensuring steady water supply for the coastal regions of Cungulla and Giru.

Townsville Council Water and Waste Committee Chairperson, Russ Cook, said the pump renewal project was about ensuring Cungulla, in the Townsville local government area, and Giru, in the Burdekin Shire, had a reliable water source for decades to come.

“Townsville City Council is committed to ensuring our community has a safe and reliable water supply now and into the future, and this $500,000 investment is about delivering on that commitment for our communities like Cungulla and Giru,” Mr Cook said.

“This project is part of the Council’s $177 million investment in water infrastructure and services this financial year.

“Besides the installation of the new pumps, the works will involve installing new structural steel beams, which will be lifted into place by helicopter, as well as some electrical works on the bridge to accommodate for the two 120kg pumps.

“While the pumps are being replaced, potable water will be trucked to the Giru Water Treatment Plant and the Cungulla Reservoir to minimise the impact to residents.”

Burdekin Shire Council Mayor, Lyn McLaughlin, said the pump renewal would provide peace of mind for Giru and Cungulla residents.

“I want to thank Townsville City Council for recognising the importance of water infrastructure upgrades across their network, and thank Giru and Cungulla residents for their patience as pump renewals are completed,” Ms McLaughlin said.

Works were expected to be finalised by the end of October 2021.

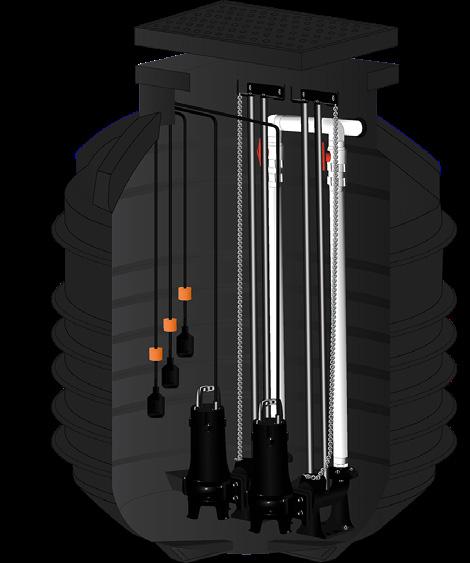

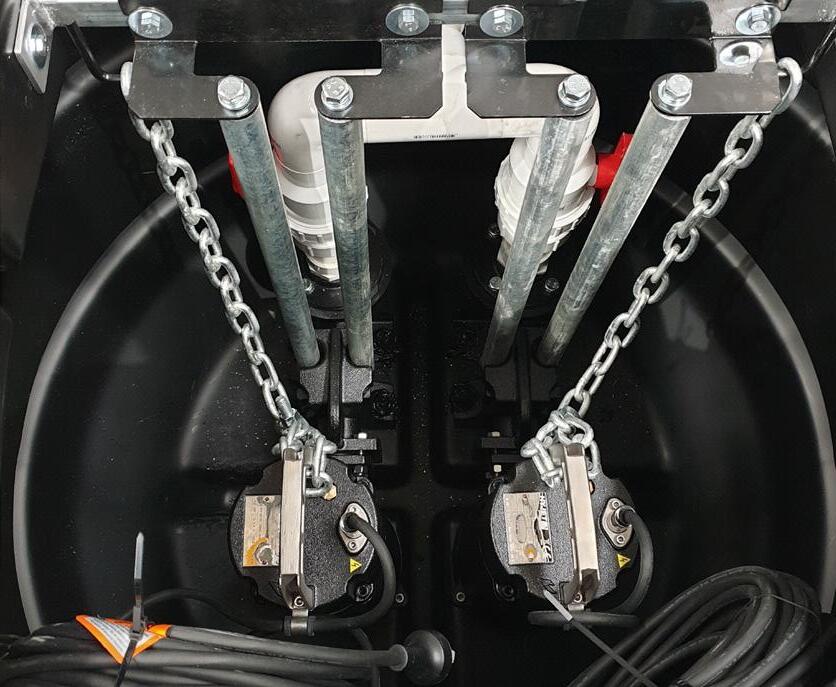

The Maxijet Polyethylene Pump Wells are typically used for stormwater and sewage applications for domestic, commercial, and industrial applications. Compatible with any submersible Pedrollo, Zenox or Hyjet Pumps.

These Polyethylene Pump Wells can be pre-plumbed with single or dual pumps and are supplied with barrel unions, valves, non-return valves and outlets all with interconnecting pipework.

To meet local standards and codes for underground soil loading requirements, the MPPS Series are engineered in compliance to meet Australian Standards.

Sizes available: 100L-5000L, larger sizes in fibreglass available on demand.

The HMV Series are variable speed drive stainless steel vertical multistage pumps. Designed for pumping non-loaded fluids for pressurising systems; irrigation; drinking and glycol water; water treatment; heating and air conditioning; washing systems suitable for both commercial and domestic projects throughout Australia.

The HMV Series are at the pinnacle of quality and innovation, Maximum efficiency - low power consumption and cost efficient.

Driven by the E1-E318 Variable Speed Drives, and Manufactured in Italy. Systems built to size and applications.

The first tender for Stage 2 of the Haughton Pipeline was released by the Queensland Government and Townsville Council in November, signalling the start of construction.

Detailed design work for the pipeline and pump station is now set to be finalised with delivery partners.

The tender for long lead items was expected to be released by the end of 2021 and tender for construction of the pipeline will be released in early 2022.

Queensland Premier, Annastacia Palaszczuk, said her government was providing up to $195 million in funding for the project.

“Stage 2 of the Haughton Pipeline project will go a long way in ensuring Townsville water security for decades to come,” Ms Palaszczuk said.

“My government knows how important this project is for Townsville’s future and that’s why we are providing $195 million in funding.

“This project will also support hundreds of jobs during construction, boosting North Queensland’s economic recovery.”

Queensland Minister for Resources and Member for Townsville, Scott Stewart, said the project would provide a substantial economic boost for the city.

Townsville City Council has formally signed off on a detailed roadmap for the project, including approving increasing the budget to $274 million, which includes an appropriate contingency allowance.

Townsville Mayor, Jenny Hill, said a considerable amount of planning had been undertaken by Council officers and specialist consultants in the past 12 months.

“Completing the second stage of the Haughton Pipeline will give Townsville the water security it needs as it grows over the next 50 years,” Ms Hill said.

“It realises the recommendation made by the Townsville Water Security Taskforce’s final report of November 2018 that a pipeline be constructed between the Ross River Dam and the Burdekin River near Clare, to enable the dam level to be managed to best deliver water to the city.

“I thank the Premier and her ministers for their willingness to work with Council to deliver this game-changing infrastructure for our city.”

Ms Hill said Council would fund all costs above the $195 million provided by the State Government.

“The Council is committed to securing Townsville’s water security and this project will do that,” Ms Hill said.

“It will mean that Council will need to provide up to $79 million to fund this vital investment in our city’s longterm future.

“We will manage the risks in this project closely to put downward pressure on costs, but we are not going to cut corners. This piece of infrastructure will provide water security for the next 50-80 years and we will do it right.”

“Stage 2 of the Haughton Pipeline will deliver water security, but it will also deliver jobs,” Mr Stewart said.

“The project is expected to support hundreds of jobs in the region. This couldn’t come at a better time as Townsville and North Queensland continue to recover from COVID-19 global pandemic.”

Member for Thuringowa, Aaron Harper, said the Queensland Government had stepped up when the Federal Government failed to deliver on its commitment to fund the project.

“Investing in Townsville’s water security is a priority of the Palaszczuk Government – that’s why we stepped in and committed $195 million to the project,” Mr Harper said.

“This project will secure Townsville’s future.”

Mr Walker said, “The Palaszczuk Government is committed to working with Mayor Jenny Hill and Townsville City Council to get this vital infrastructure built.

“Water infrastructure projects like this one are a key part of Queensland’s plan for economic recovery.”

Townsville Water and Waste Committee chairperson, Russ Cook, said Townsville City councillors were recently briefed on the project.

“Anyone who has built major infrastructure like this knows it simply doesn’t happen overnight, and this stage of the project has presented a variety of different challenges compared to the Stage 1,” Mr Cook said.

“Construction of the pipeline and pump station is expected to be complete by the end of 2024 with testing and commissioning to be finalised by March 2025.”

AGL Loy Yang has completed $98 million maintenance works on the power station, including a major turbine and generator overhaul.

Loy Yang Power Station’s Unit 3 and the mine’s Dredger 15 were successfully returned to service following upgrades and maintenance completed by more than 1,000 contractors over approximately eight weeks.

AGL Chief Operating Officer, Markus Brokhof, said the maintenance works were crucial in ensuring energy reliability ahead of summer.

“The teams have faced some unique and challenging circumstances, with the Latrobe Valley experiencing some of the most severe weather it has seen in decades while also managing the ongoing impacts of the pandemic,” Mr Brokhof said.

“Given the challenges, we’re pleased that we have been able to employ hundreds of contractors from our local community,

bringing a much-needed boost to the region after the last 18 months.

“Everyone involved has done an excellent job at managing the obstacles which will allow for efficient and reliable operations into the future.”

AGL Loy Yang General Manager, Christo van Niekerk, said the works included inspections and maintenance works on a boiler, gas pass, cooling water and electrical plants.

“We also utilised new, innovative technology called ‘HoloLens’ to conduct critical technical works under remote supervision,” Mr van Niekerk said.

“This new technology saved time and reduced the safety risk that faces our people every day.

“I want to thank all our employees and contractors who have ensured safety remained the number one priority throughout the outage.”

A$14 million upgrade to Tasmania’s Greater Meander Irrigation Scheme Augmentation – including pump upgrades – is expected to deliver reduced costs to irrigators and farmers.

The upgrades will produce more than 11,000ML of additional, high-surety irrigation water to the 28,800ML Greater Meander Scheme.

The Federal Government will provide $5 million for the scheme as part of the $108 million National Water Grid Connections funding pathway.

Assistant Minister for Industry Development and Senator for Tasmania, Jonno Duniam, said the National Water Grid Connections is about delivering short-term economic stimulus through small-scale projects.

“This important project will convert open supply channels to new and extended pipelines,” Mr Duniam said.

“This will help to provide an additional 11,000ML of water for irrigators in the area, which will deliver huge benefits for agriculture in this region.

“It is part of a $20 million federal commitment under this funding pathway for Tasmanian projects to improve water reliability and efficiency across the state.”

The Tasmanian Government has allocated $2 million toward the upgrade of the Meander mini-hydro power station along with an additional $3.5 million for solar upgrades across a number of other schemes.

A further $7 million will be contributed from the sale of new water entitlements.

Tasmanian Primary Industries and Water Minister, Guy Barnett, said the Tasmanian Government welcomes federal funding for water projects in Tasmania under the National Water Grid Connections funding pathway initiative.

“The Tasmanian Government is on track to deliver our ambitious target to grow the farm gate value of agriculture

to ten billion by 2050 and irrigation is an integral part of that strategy,” Mr Barnett said.

“The Greater Meander Scheme is a great example of the Tasmanian and Australian Governments partnering with farmers to deliver water at a reduced cost by generating renewable energy, giving great water surety to farmers and also contributing to better river health.”

The works, including pipeline extensions, converting riparian flow to piped water, intake screen and pump upgrades and the installation of solar power plants to pump stations, will result in an additional high-surety irrigation water being delivered to farmers and reduced costs to irrigators.

EXCELLENCE – MADE TO LAST

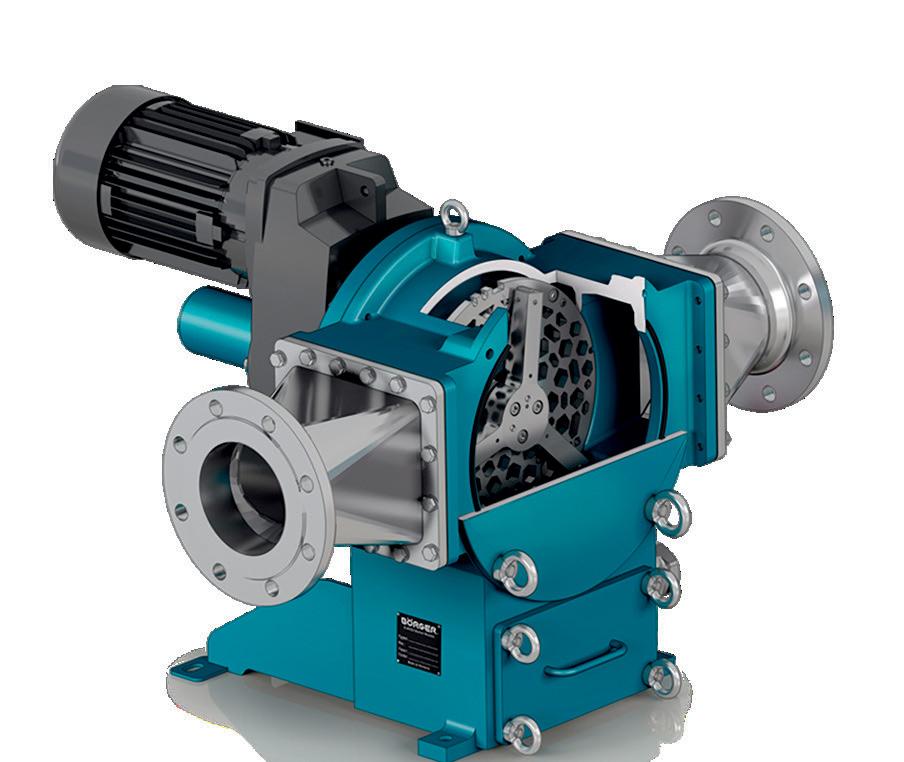

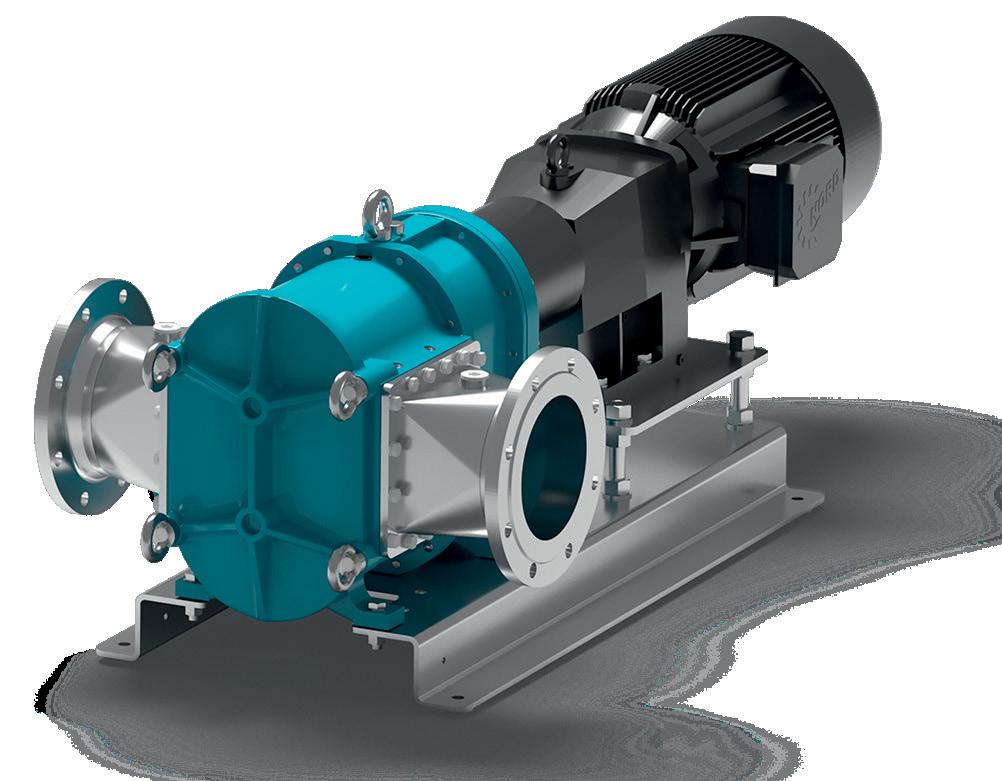

Mobile, stationary or submerged – Börger configures and builds each rotary lobe pump in line with the requirements of the specific application.

The application options of Börger pumps have expanded with the new B BLUEline Nova rotary lobe pump. The BLUEline Nova pump ensures the best efficiency even with high pressures. Börger pumps are available in 25 pump sizes with flow rates between 1 – 1,440 m³/h.

Further to this, Börger also offers three different macerators - providing efficient chopping operations and capabilities, ensuring downstream machines and pumps to perform smoothly.

The 2021 PIA AGM took place online in early November, allowing Members to attend from across the country from their offices or at home, no matter what restrictions were in place in their state or territory. While the year did not go as planned, attendees were able to hear about some of the successes and activities that did happen, and plans to resume to more in-person meetings and training in 2022.

The PIA reported that while COVID-19 continued to have an impact on some activities over the course of 2021, it has continued to successfully liaise with government and other organisations on items of interest to the industry, and membership has continued to grow, putting the Association in a good position for 2022.

Industry engagement

Due to ongoing restrictions making it difficult to organise in-person events for most of the year, the PIA was only able to hold one Technical Meeting and one Pumps and Systems training course.

The Pumps and Systems training course took place in Melbourne in late March, with 21 people to date having completed the course. As there are a number of competing training courses across the country, the PIA will look at ways to increase interest in the nationally-recognised course in 2022.

In April, a Technical Meeting was held in Perth at Tsurumi Australia with over 30 people in attendance. Attendees heard from PIA President, John Inkster, and Tsurumi Australia Managing Director, Michael Woolley, before hearing a presentation about Tsurumi Australia and taking a factory tour.

At the time of the AGM, there was an online seminar scheduled for late November on Energy Efficiency of Pipelines. The seminar was taken by Rob Welke, Managing Director at Tallemenco, and looked at energy optimisation of pipelines and pipeline performance degradation. A second online seminar is planned for Q1 on flow metering for onsite pump testing.

The PIA has also been busy undertaking other activities to engage the industry, and provide support and assistance where needed. A key engagement has been with the Queensland Building and Construction Commission (QBCC), following a request made for more clarity on works being

undertaken that are covered by the Plumbing and Drainage Act 2018 so companies could ensure compliance and avoid fines. Discussions with the QBCC were initiated in July regarding the licensing of PIA Members for work covered by the Act. The case was tabled in early October with the Services Trade Council (an instrument of the QBCC) and was under consideration in November with the PIA awaiting a formal response. The PIA aims to get a better understanding as to what needs to be done so that regulations aren’t broken by the many small to large companies that are based or do work in Queensland.

The PIA continued to engage with Australian and international standards organisations, and government departments to review and provide expert comment on related standards.

It was on three Standards Australia committees in 2021:

• FP-008 Fire Pump Committee

The only notable work to take place on this Committee over the year was the review of AS2419.1 Fire hydrant installations, Part 1: System design and installation. This standard has been under review for a number of years and PIA submitted a number of comments, with a majority of them accepted. The revised standard has now been published

• ME-030 Pump Committee

ISO 21630:2007 (vers. 3) Pumps - Testing - Submersible mixers for wastewater and similar applications came up for review

• EL-58 Energy Efficiency for Swimming Pool Pumps Committee

PIA was asked for input on Draft AS 5352 Swimming pool and spa heat pump systems. The Association submitted substantial reviews of the standard to sort out some issues and to try to clear up if pumps were included in the energy efficiency calculations or not. The draft standard was expected to be released for public soon at the time of the AGM

Other important work and changes included the review of draft changes to the NCC 2022, as well as aged standards; and support was provided to ensure the PIA’s Pump Technical Handbook was up to date with the most current standards in preparation for a new edition to be released in 2022. Two items of note were ISO 50001 Energy management systems – Requirements with guidance for use will become Australian Standard AS/NZS ISO 50001:2021; and Europump announcing it is now pushing legislators in Europe to implement the extended product approach on behalf of pump manufacturers to have any energy calculations also include the pump, motor, drive and controller.

With training taking a backseat again in 2021, a major focus of the year was updating the Pump Technical Handbook. It has taken many hours and the help of volunteers to complete, with the aim to release the new version in Q1. The PIA would like to thank all those who took the time to lend their expertise to review the Handbook.

The PIA reported that with the effects of the pandemic expected to continue into 2022 and the uncertainty of how it will play out, it is difficult to formalise a business plan for the year. However, provided the situation allows it, the Association intends to hold a number of Breakfast Meetings, Technical Meetings and online seminars over the year.

The PIA also hopes to continue to grow its membership in 2022 to more effectively represent all businesses, with the incoming council encouraged to reach out to the larger pump organisations in particular for their support and experience.

The AGM ended with a presentation by Jason Cunningham, Co-founder and Director, Head of Business Advisory at The Practice, about the key ingredients to business success based on his book Have Your Cake And Sell It Too – the 7 Key Ingredients of Business Success.

Jason provided an informative and entertaining presentation, with attendees hearing about some of the ingredients they need to grow their business asset for tomorrow, while enjoying the profit and lifestyle rewards now, and securing their future.

The virtual PIA AGM was facilitated by Pump Industry magazine publisher Monkey Media and hosted by Monkey Media Managing Editor, Laura Harvey.

Thanks to their construction, the FK Series – DAB’s professional submersible wastewater pumps – can guarantee reliability, efficiency and ease of maintenance, all of which are important values for installers and maintenance engineers.

Suitable for the transfer of wastewater in public buildings, industries, subways and parking lots, the FK range has been designed for pumping wastewater with varying solids, from the drainage of surface water, up to residential wastewater, from wastewater with high fibre content up to industrial wastewater.

Conveniently, the FK range is available with either a vortex or single channel impeller depending on the application.

Why is the FK Series reliable?

New non-clogging vortex impeller

The guarantee of operation comes before efficiency. A new design of the vortex impellers and the total solid handling are respectively the two guarantees to have no-clogging issues.

Moisture sensor

Supplied as a standard option, it allows the prevention of any engine failures due to possible water infiltration in the oil chamber seals.

Bi-component coating

Unlike conventional water-based paints, the bi-component coating is more suitable in aggressive environments such as wastewater. It prevents oxidation and the consequent wear of the pump.

IECex and ATEX Compliant

The FK Series is IECex and ATEX compliant when required for sensitive projects.

New auto coupling DA-V

The seal mounted on the new auto coupling ensures a tight contact, which optimises pumping efficiency while minimising operating costs.

Why is the FK Series efficient?

New IE3 motors

The new IE3 premium efficiency motors drastically reduce energy operating costs. Given its low running temperatures, it guarantees operation up to 40°C, as well as thermal protection being standard.

New single channel hydraulics

The new high efficiency single-channel hydraulic has been designed especially for continuous wastewater operations with high flow demand and low fibre content.

Why is the FK Series easy to maintain?

One cable to the pump

A single standard cable that encloses power and signal inputs together, drastically reduces the possibility of problems due to cuts or leaks.

Single-unit cartridge seal

A single-unit cartridge seal is a great advantage for maintenance of the pump as it allows the removal and insertion of the seals in less time. It is an exclusive DAB patent: a double mechanical seal Sic-Sic with opposite faces, independent from the rotational direction of the shaft.

ENERGY EFFICIENCY

NEW IE3 MOTORS

The new IE3 high efficiency motors drastically reduce operation energy costs. Due to the low overheating temperatures, their operation is guaranteed for temperatures up 40 °C. Thermal protection is standard.

IECex approved version available.

The cartridge is a great advantage during maintenance of the pump, as it enables removing and replacing the seals in less time, with full reassurance that the operation has been carried out correctly. This is an exclusive DAB patent, with double Sic/Sic seal with opposite faces independent from the direction of rotation, with Viton elastometers and Corteco.

The reliability comes even before efficiency. A new design of Vortex impellers, and the guarantee of always having a total free passage, are two of the most important functionalities of the new FK. In compliance with European Standard EN 12050-1

NEW SINGLE-CHANNEL HYDRAULICS

New high efficiency singlechannel hydraulics for applications requiring continuous high flow rate operation with loaded water with low fibre content. In compliance with European Standard EN 12050-1

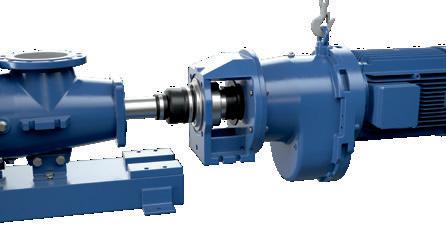

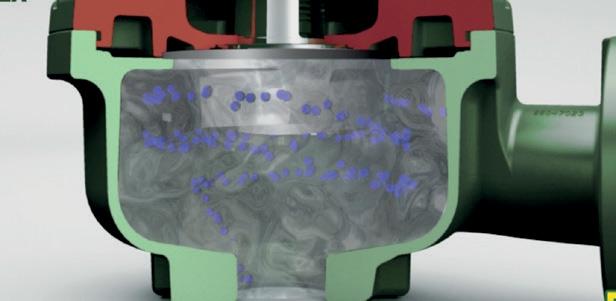

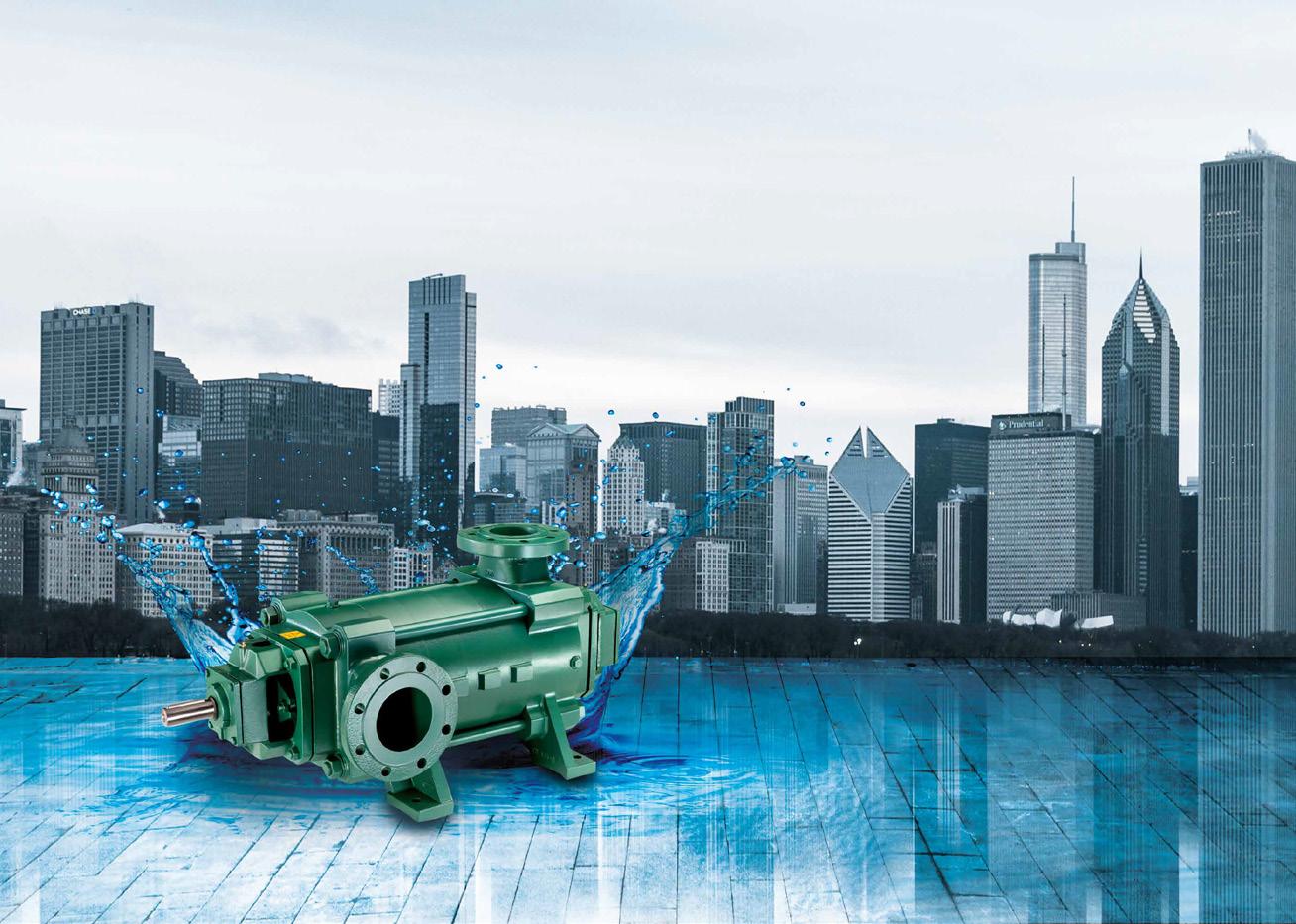

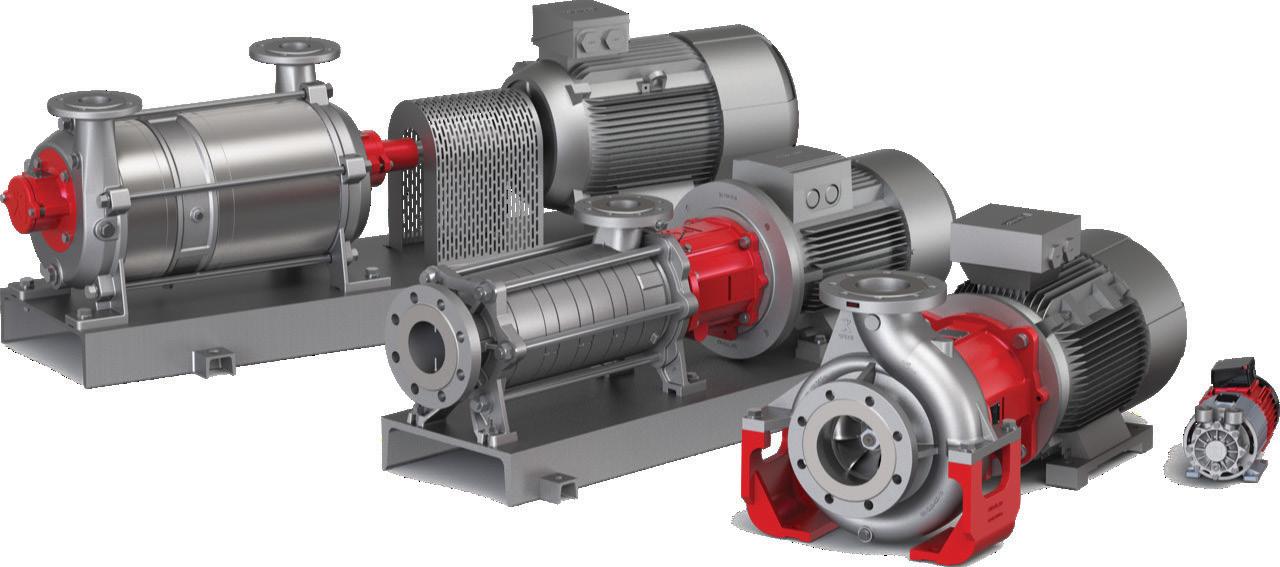

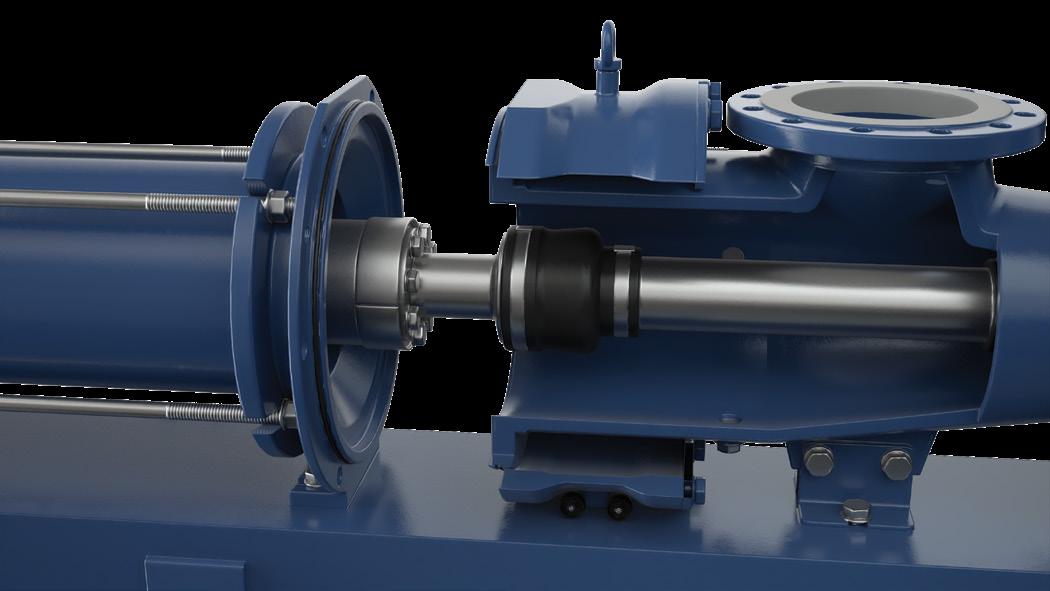

Ebara has rethought the hydraulic design used in multistage pumps. Utilising the latest in computational fluid dynamics and design, followed by rigorous testing, Ebara has developed a unique impeller design that offers solutions and value to the customer – the Shurricane.

The imbalance of forces acting on the front and rear shrouds of a conventional impeller results in axial thrust. This thrust load is compounding in multistage pumps, and has to be allowed for in the pump design.

For pumps with conventional impellers, the existing solutions include having a thrust bearing built in the pump, or to use a special motor fitted with a larger thrust bearing. Both are costly and can be complicated. Another solution has been to simply have a smaller diameter back shroud to reduce the thrust.

Ebara has rethought the hydraulic design used in multistage pumps. Utilising the latest in computational fluid dynamics and design, followed by rigorous testing, Ebara has developed a unique impeller design that offers solutions and value to the customer.

The optimised shape of the Shurricane maintains high efficiencies and very significantly reduces the axial thrust – meaning that any standard IEC motor can be used and bearing life is improved.

Built like a Katana

A Katana is a traditional Japanese product manufactured with care and precision. Only years of experience can give the necessary capacity to build a masterpiece.

This is what Ebara does with its pumps. The result of over 100 years of Japanese experience in pump manufacturing, its pumps offer highquality performance, reliability and cutting-edge technology.

Ebara’s Shurricane vertical multistage pumps are manufactured to the highest standards of quality, and achieve reliable operating performance by means of strict technical evaluation criteria and control programs that involve the whole manufacturing process.

Shurricane pumps are suitable for a wide range of applications, in the industrial, commercial and agricultural fields. They can be used at water treatment plants (for reverse osmosis and filtration), for the pumping of hot or cold water for HVAC systems, for the pumping or boosting of water in general, and in boiler feed, irrigation and fire fighting systems.

The Ebara Shurricane pump utilises cutting-edge technology, designed in Japan and manufactured in Italy.

The pumps can be coupled with any motor, anywhere. Optional materials are part of the unique hydraulic design, and there are optional connections for customers to consider.

Innovative hydraulic solutions

• Commercial motors can be fitted to all of the pump models without any modifications thanks to low pump axial thrust load

• Long life of the motor bearing

• High pump efficiency classified in MEI > 0.7 as the most efficient models

• Patent Application

Energy saving

• High pump efficiency with MEI (minimum efficiency index) > 0.7

• E2 motors fitted as standard with E3 available as an option

• Suitable for use with variable frequency drives for further energy savings

Piping connection options

• The various pipe connections are available depending on the application requirements

• The external dimensions can be adjusted to the replacement of the existing pump in the wide majority

Easy maintenance

• The cartridge shaft seal enables the plug in replacement of the shaft seal without disassembling the motor bracket

• The spacer coupling allows easy maintenance without having to remove heavy motors 5.5kW and above

Smart plug solutions

• Air ventilation plug

• Water filling and sensor plug

• Commercial sensor fitting

• Measurements for suction and discharge pressure/drain

The optimised shape of the new Shurricane impeller maintains high efficiencies and very significantly reduces the axial thrust – meaning that any standard IEC motor can be used, and bearing life is improved.

The disruption of the global supply chain is causing havoc for many businesses. Time delays, exorbitant increases in shipping costs, strikes and threats of more strikes have all caused a reshuffle of priorities in many a boardroom. Crusader Hose, also affected by these worldwide events, has been working tirelessly to help support its customers during these unprecedented times.

The worldwide pandemic has illustrated the vulnerability of the global supply chain and has forced many businesses to review their supply chain strategies. Analysts writing for Harvard Business Review encourage businesses to examine their Tier 1, Tier 2 and other level suppliers. Relying heavily on importers is no longer seen as a viable business model. Sourcing from local manufacturers for goods is being encouraged to reduce risks associated with supply chain disruptions.

As an essential service provider and Australia’s local manufacturer of industrial layflat hose, Crusader Hose has been able to keep its doors open and continue to service the mining, industrial, agricultural and firefighting sectors. It has delivered well over 550,000m of hose since the first major lockdown.

Crusader Hose, an Australian-owned company, has been manufacturing layflat hose for over 35 years and has grown from a small, family-run business to a medium-sized business with more than 40 employees. In its early years, the volume of imported hose on the streets had put significant pressure on the company. However, with its culture of continuous improvement, its many investments and machine upgrades have been producing world-class hoses. Crusader Hose has forged many strong partnerships throughout Australia and is the name many companies trust.

Working closely with industry, Crusader Hose has been designing, manufacturing and supplying the pumping sector with layflat hose for water logistics and bore water pumping. During these challenging times, the Melbourne-based factory has been working around the clock to support resellers in meeting the demands of their customers.

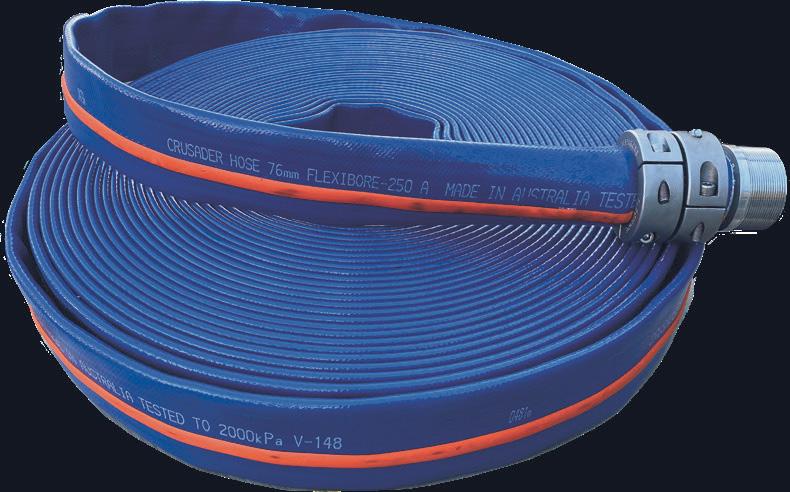

Flexibore® flexible rising main is the ideal solution for the installation of submersible pumps. Manufactured with a TPU-extruded textile reinforcement of high-tensile polyester, Flexibore® can withstand the weight of the pump and the weight of the column of water without a safety cable. The flexible nature inherent to the hose makes handling Flexibore® easy and simple compared to rigid pipes; its swelling feature of up to ten per cent makes it extremely efficient in reducing pumping costs and friction loss. By dilating under pressure, no internal build-up of iron bacteria occurs, as seen with rigid pipe use such as steel or fibreglass.

Flexibore® is compact, requiring less trucks for transportation and a smaller workforce and machinery for installation. The Flexibore® systems are designed to handle the small pumps often used with shallow bores to the very large pumps, which handle the ultra-deep bores to 400m. Installation rollers and lifting clamps are available to suit the different systems.

Waterlord®, their heavy-duty layflat hose, is ideal for moving large volumes of water. Manufactured in large diameters of up to 12”, Waterlord® moves water in quickly and safely, assisting in keeping projects efficient and on time. The high-pressure reliability of Waterlord® comes from the world’s-best manufacturing process of the TPU (thermoplastic polyurethane) thru-the-weave extrusion encasing a robust textile reinforcement. It is manufactured in one continuous length of up to 250m and can handle high-working pressures; its tough exterior can withstand all types of terrain – urban and regional. Both flanges and couplings are available, which can easily connect to existing pipelines.

Its progressive engineering department has designed and manufactured turntables and reeling systems to safely and efficiently deploy and retrieve multiple lengths of hoses. Although a smaller workforce suffices when unrolling shorter lengths of hose, turntables and hose reel systems are ideal for pipelines. Interchangeable spools make it quick and easy to handle multiple lengths. Many operators are asking for the Waterlord® layflat hose reeling system because of its inbuilt properties: keeping multiple lengths compact, and making layflat hose easy to handle and deploy.

“We have seen the importance of supporting local manufacturers in the preservation of the supply chain for successful business,” said Francois Steverlynck, Managing Director of Crusader Hose.

“Buying from an Australian producer gives you peace of mind regarding backup, quality, quick turnaround and excellent customer service. We stand by our products so your needs will be looked after.”

Local manufacturing is critical in these times of uncertainty. Let Crusader Hose be part of your business success for the timely delivery of the products you need.

Waterlord® reeling system: fast, compact and easy to use for rapid dewatering.

it with hydrolysis-resistant polyurethane.

Proudly manufactured in Australia by Crusader Hose, Flexibore® 250 is made to suit most bore water pumping applications and is manufactured in a large range of diameters from 40 mm to 152 mm, in continuous lengths of up to 250 m.

With a high burst pressure for deep bore water pumping, the Flexibore® 250 can handle the weight of the pump plus water up to 250 m without a safety cable.

Quality you can trust

Deep ground water pumping up to 250 m

Ultra-high tensile strength for large submersible pumps

Flexible, so easy to install & retrieve

Swells up to 15%, avoiding internal build-up

Rigorously tested

Secure couplings

Lower pumping costs and friction loss

Contact us today on +61 3 9720 1100 or email sales@crusaderhose.com.au to learn more or request a quote!

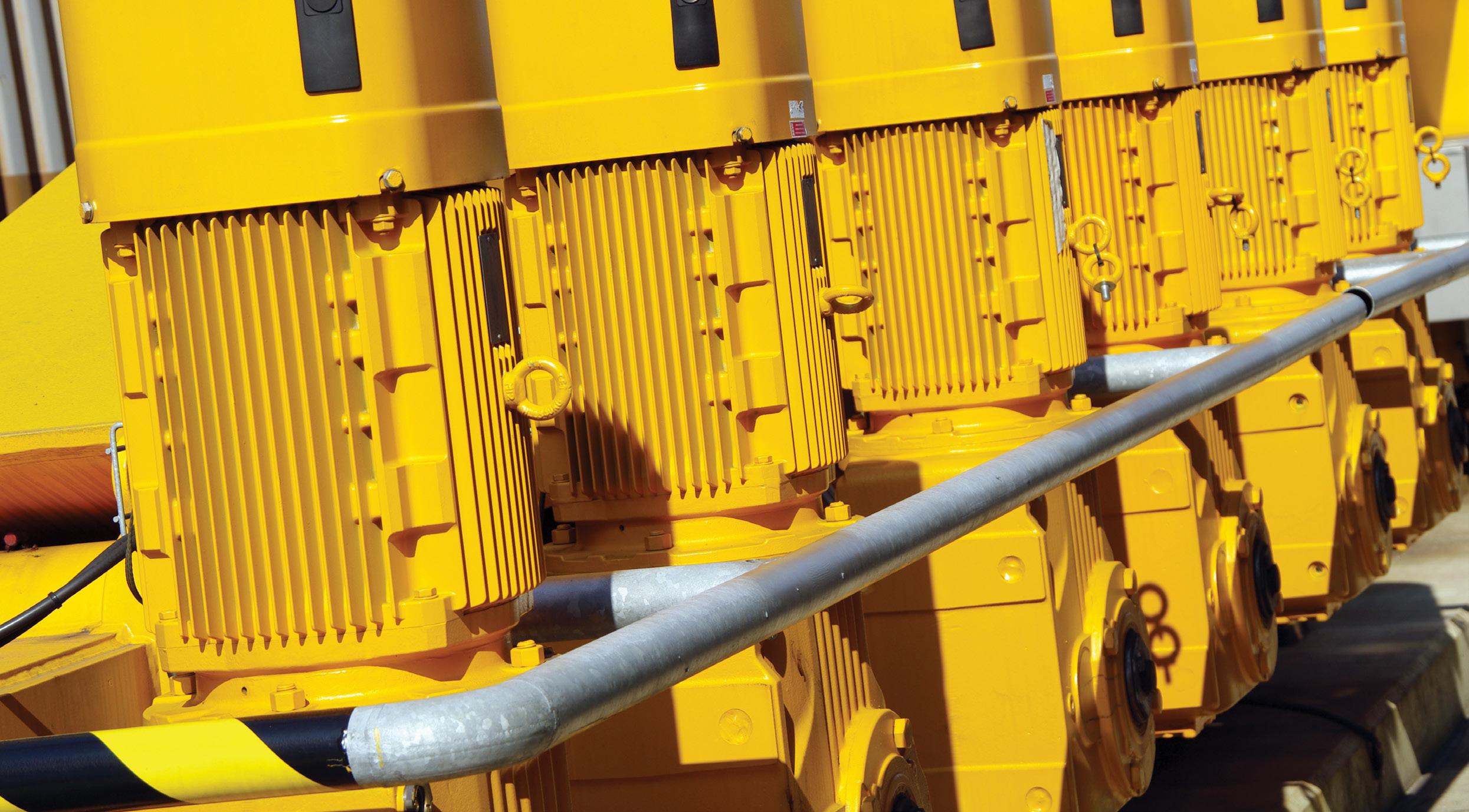

WEG has a complete range of medium voltage motor control products and the expertise to offer optimised solutions for any application. Contact WEG Australia to discuss the options available for single and multi-pump applications.

WEG Drive and Soft-starters

• WEG MVW01 medium voltage drive

• WEG MVW3000 medium voltage drive

• WEG SSW7000 medium voltage soft-starter

All WEG medium voltage drive panels incorporate the following user benefits:

• Fully withdrawable power cells. The power cells are rack-in and rack-out for ease of use and safety

• Key interlock system that ensures mechanical and electrical interlocking for safe panel access

• Long-life plastic film capacitors, extending both the product lifespan as well as the maintenance cycle. This technology eliminates the need for reforming the capacitors after storage, even after prolonged storage

WEG MVW01 High Efficiency Drive System

WEG MVW01 medium voltage variable speed drive uses state-of the-art high voltage IGBT technology and consequently boasts industryleading drive efficiency of over 98.5 per cent. The MVW01 drive also offers the flexibility of either integral dry-type transformer or separate outdoor oil-type transformer, which equates to extraordinary reduction in heat loss and footprint in the substation room.

MVW01 highlights:

• Transformer integral dry-type, or outdoor oil type

• High efficiency of >98.5 per cent

• 300kW up to 24MW

• 3.3kV, 4.16kV, 6.6kV

• VSD panel dimension:

» 2316 x 1000 x 980 (h x w x d in mm) – up to 850kW

» 2190 x 2600 x 960 (h x w x d in mm) – up to 2800kW

WEG MVW3000 Multi-Level H-Bridge Drive System

WEG MVW3000 medium voltage variable speed drive range offers plug and play 3-cables-in and 3-cables-out design. It comprises integral transformer, optional integral switchgear, and modular power cells providing motorfriendly multi-level sinusoidal output voltage. Perfect for standard motors, it can be applied to both new and retrofit installations without concern for the motor insulation system. It is also beneficial for applications of long cable lengths.

MVW3000 highlights:

• Integral solution – plug and play

• Sinusoidal motor-friendly output waveform

• 300kW up to 12MW

• 3.3kV up to 13.8kV

WEG SSW7000 Medium Voltage Soft-starter

WEG SSW7000 soft-starter boasts state-of-the art motor control and protection. It has multiple starting control mode options, including a special algorithm for pump starting and stopping designed to eliminate pressure overshoots and water hammer. The SSW7000 incorporates built-in automatic bypass function as a standard feature and can also be programmed for DOL starting in the event of a thyristor failure.

SSW7000 product highlights:

• Built-in automatic bypass

• Application specific starting control such as Pump Torque Control

• Starting option for DOL can be selected to allow starting even in the event of a thyristor fault

• 300kW up to 10MW

• 3.3kV up to 13.8kV

Customised Solutions

WEG medium voltage variable speed drives have proprietary PLC functionality available as an optional accessory. This allows customised programming of customer specific application requirements. One such application is multi-pump starting using one VSD. In this scheme, one VSD is able to start a pump and then bypass that motor to the grid using its synchronous bypass functionality. In this way the VSD can be used to start multiple pumps in a system, and speed control can be applied to one selected unit to allow for flow control.

Starting scheme for multi-pump using one VSD with synchronous bypass functionality.

Are you ready to dive into every aspect of Caprari’s product range? Discover our selection of webinars, your professional training resource available anytime, anywhere.

Listen to our webinars to get to know all of our products’ characteristics and applicable sectors, as well as exclusive Caprari patents, presented by our very own Product Manager.

Visit Digital House, where, as always, you will find a wide array of product videos, reference projects and free-to-download information catalogues.

Need more info?

Thanks to Digital House, you can now ask our Product Manager or Sales Department directly via a live meeting.

Step into the digital world of Caprari.

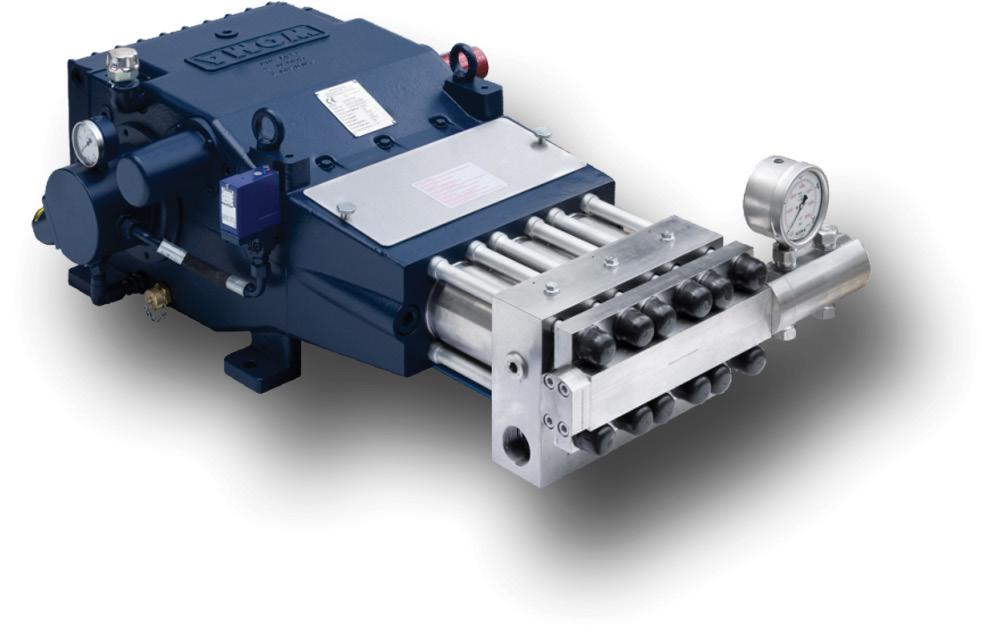

Thanks to their reliability, top performance and versatility of use, Caprari’s PM horizontal pumps series – built to withstand high pressures – have long stood as a reference point in the market, representing the best that current technology has to offer.

These pumps can be used in the water industry, the drinking water sector, reverse osmosis snowmaking and marine applications. They are specially designed to be consistently durable and to function in such a way that the need to replace wearable parts is kept to a minimum.

Their robust structure is resistant to mechanical stress, thanks to specially designed dimensions which allow for especially high performance and operation stability up to 100 bar of pressure.

High efficiency at the BEP, ensured by optimised geometry in the blade profiles of the impellers and diffusers, is one of the series’ biggest strengths. Furthermore, wear is reduced to a minimum as the hydraulics are equipped with an axial thrust compensation system.

The sizes of the hydraulics which make up the PM Series cover a wide range of flow rates and are available in cast iron, stainless steel and duplex.

It is exactly these PM machines, built for high pressures up to 100 bar, which benefit from the new size 65 hydraulic models. Depending on how the pump is going to be used, either a packing seal or a mechanical seal can be selected. The mechanical seal guarantees perfect regulation and protection against leakage, while the packing seal boasts superior ease of assembly and maintenance, reducing the risk of machine downtime.

The H version PM65 with 4 poles is the configuration that allows for use with superheated water at temperatures of up to 120°C – though it is necessary to carry out checks on the 2 poles depending on the conditions the pump

will be used in. The materials selected here guarantee durability even in such thermally heavy duty operating conditions. Vibration propagation is minimised in a great deal of operating conditions. As a result, barely any noise is created, which is a vital benefit especially when placing several machines at the same site.

Such reliability, top performance and versatility are the fruits of a great many years of experience in engineering, construction and application in the most diverse fields of use.

• Up to 100 bar of delivery pressure

• Metallurgy construction to guarantee high performance

• Reliability and low costs with regards to both operation and maintenance

• High hydraulic efficiency

• Wide flow rate capacity

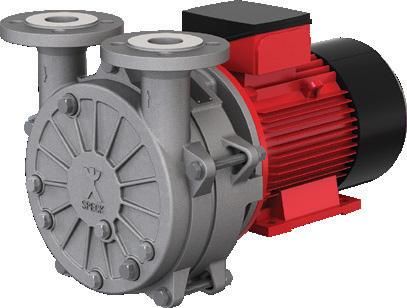

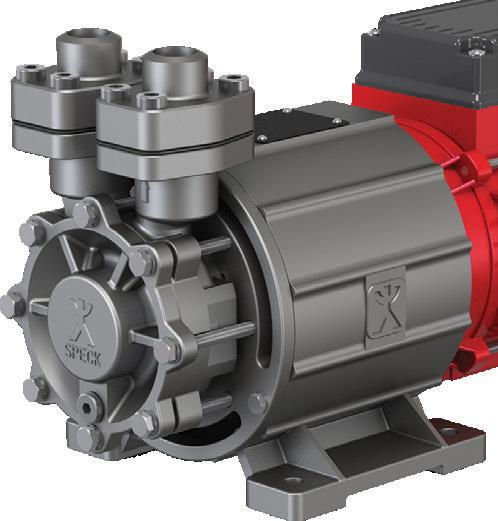

The Speck Group, with its headquarters in Roth in Germany, is a family-run enterprise in the mechanical engineering sector that manufactures high-quality pumps and compressors for industrial applications.

Speck has been active in this market for over 100 years and supplies its products to original equipment manufacturers and systems manufacturers in over 80 countries. Manufacturing is usually order-based. A strong customer focus, high levels of expertise and the development of customised solutions are the main factors which set Speck apart in these activities.

Speck Industries is a subsidiary of Speck Pumps of Roth, Germany. Servicing the ever-growing needs of OEMs and distributors in the region, Speck Industries offers a convenient local hub for Speck pump sales, distribution and technical support.

Speck offers fast delivery throughout Australia and New Zealand with our tailored transport arrangements. With our hub situated in Perth, we’re well located to deal with suppliers in Europe and customers in east Australia and New Zealand all within the working day.

Our local branch stocks a range of pumps, such as side channel, boiler feed, liquid ring vacuum, positive displacement and more to cover a wide range of industries from plastics manufacture, food and beverage, industrial heating and cooling, chemical and pharmaceutical plus a wide range of others.

Our experts on hand will help you determine the best solution for your specific flow requirements.

Our specialised products are principally used in medical technology, the chemical and pharmaceutical industries, cooling and tempering appliances and in the plastics industry. Speck is very export-oriented and employs over 575 staff members worldwide.

Products from Speck are characterised by a wide range of available variants which is specially tailored to the customer’s needs. Our staff in the Technical Department are constantly working on new solutions and further developments to our existing products that help our customers move forward – day in, day out.

Over time, pumps and associated components are subject to wear, corrosion and cavitation damage in service, resulting in downtime, reduced efficiency and service life, increased costs, and in some applications, safety hazards. As this deterioration occurs on the surfaces of the components, having a high-quality protective coating installed by an experienced company can preserve assets, extend their service life, and improve safety.

The Belzona Polymeric range of metal, rubber and concrete repair and protection materials – distributed in Australia solely by Rezitech – allow the rebuilding and protection of damaged machinery and equipment, ensuring they will stand up to chemical attack, constant immersion in liquids and other industrial environments.

The Belzona range reduces labour time and costs by eliminating the need for disassembly, welding, and postweld heat treatment; decreases costs by increasing asset availability; and enhances safety by allowing in-situ cold work with solvent-free materials.

Belzona fixes common problems associated with industrial equipment by:

• Extending service life and delaying replacement – the products provide a superior layer of protection for damaged equipment

• Simplifying maintenance procedures and reducing costs – the polymers are resistant to abrasion, erosion, chemical attack, corrosion, and are relatively easier to clean than bare surfaces

• Improving operational efficiency – polymer surfaces are easier to work on compared to bare surfaces, resulting in less to worry about during operations

• Minimising downtime – damaged industrial equipment can disrupt operations. Polymeric solutions minimise downtime and don’t get in the way of production

Belzona protective coatings feature:

• WRAS approval

• AS/NZS 4020 approval for drinking water use

• High adhesion

• Low surface tension

• High mechanical strength

• No shrinkage

• Electrical insulator

• Smooth surface

• Long working life

• Chemical and impact resistance

• Safe for constant immersion

• Safe for cold application

• Environmentally friendly

In 2010, a major Australian water utility was undertaking scheduled routine maintenance on a pump and was extremely happy to find that the Belzona coatings that had been applied 19 years previous were still intact and evident, and there was no additional repair or coating of the internal casing/cover required. Furthermore, an independent test by the water authority confirmed efficiency gains in flow capacity were accomplished between 4-7 per cent.

In 2012, Belzona was installed on cones in a cyclone wash infiltration plant in a limestone quarry in England. As the

cones were suffering heavy levels of abrasion, the mean time between failure was unacceptable, with unprotected clones failing within one month and rubber-coated cones only lasting for six months. The downtime and replacement costs were costly for the client.

Belzona was used for a trial application to increase the working life of the cones, and resulted in the cones lasting 18 months – a lifespan increase of 12 months. As well as reducing the cost of replacement, the largest cost saving for the plant was the reduced downtime. After the successful trial, Belzona was made the standard solution for all abrasion areas within the plant.

Your trusted and experienced Australian distributor for Belzona

Rezitech is an 100 per cent Australian-owned company and the sole distributor of Belzona in Australia.

It has been involved with major plant upgrades and expansions projects for many major companies servicing a wide range of industries. Its team of experienced industry professionals are able to diagnose a problem and recommend a solution, as well as apply Belzona coatings either on-site or at its dedicated workshop.

Rezitech can also provide on-site supervision, NACE qualified coating inspectors, and in-plant seminars and on-site training.

Rezitech combines the wide range of Belzona materials with its application expertise to provide high-quality, longlasting repairs for all types of equipment and structures.

• Unique Australian design

• 100% Australian Manufactured

• Unique durable plastic liquid ring vacuum pump

• More resistant than stainless steel

• Added protection against chemical attack

• For all your liquid ring vacuum pump supply and repairs

• Flowtech and Robuschi liquid ring vacuum pumps available in a multitude of materials

• Flowtech conical cone design has a fully shrouded rotor for added strength and protection against failure due to harmful carryover. This pump also has detachable bearing housings for easy and quick change over of impeller shaft bearings

• On-site volumetric testing on liquid ring vacuum pumps with after test report provided

• Dedicated application engineer to support you in pump selection or pump package design

• Internal coating capabilities with Belzona polymer coatings

• Extended life cycle of pumps through internal coating of components with superior wear resistant Belzona coatings

• Resistant to rusting and seizing when used on priming pump applications where pumps are left standing without operation for long periods of time

• Sewerage waste extraction

• Decades of experience in repairing pumps

• New pump warranty on all pump repairs

• Liquid vacuum pump repairs

• Repairs to split case, multistage, submersible, slurry, volute and multitude of other pump configurations

• Rezitech’s workshop bring you superior engineering capabilities in the area of repair to a multitude of rotary equipment componentry ie pump components, induction fans, screw augers, roller shaft repairs

Now in its eighth year, Pump Industry’s State of the Industry explores how the industry fared in 2021, how this compared to expectations, and the challenges and opportunities 2022 is expected to bring. This year’s survey uncovered a renewed optimism and reduced uncertainty as the industry begins to emerge from the shadow of the pandemic, provided a meter of sector performance over 2021, and provided insight into the key factors expected to shape the industry over 2022.

On the whole, survey respondents were anticipating improved performance in 2022 and growth in work volumes in key sectors. And while COVID-19 undoubtedly affected the industry in 2021, the majority of respondents reported a decent year and expected things to keep improving.

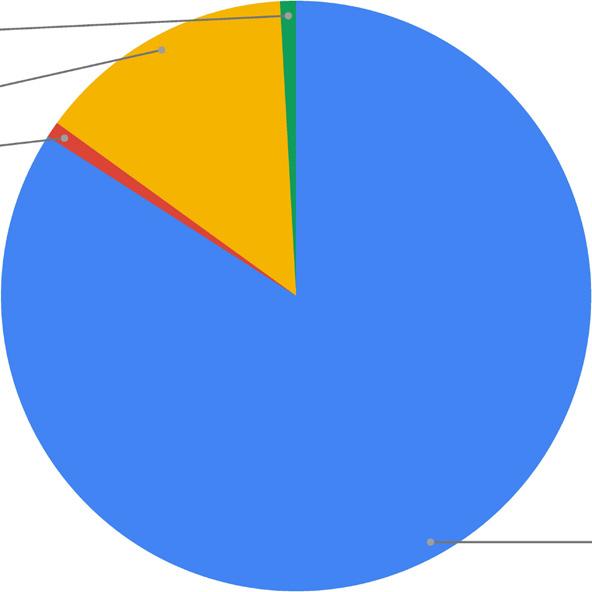

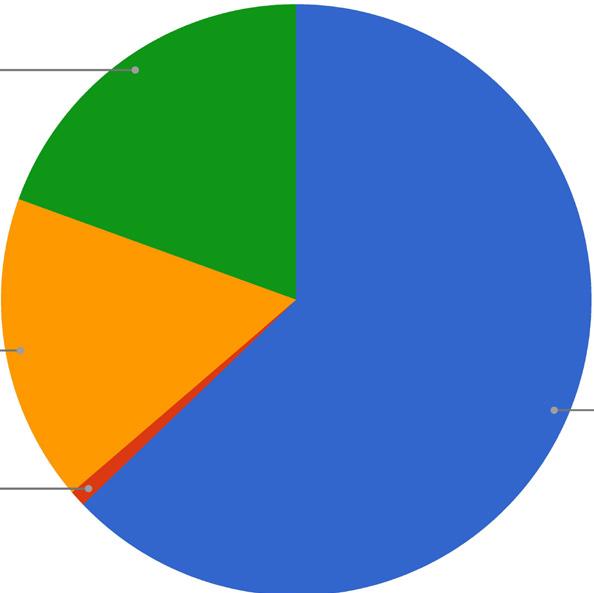

Despite the vicissitudes of the past few years, many within the pump industry are looking to 2022 with a renewed sense of optimism and reduced uncertainty, with 84.07 per cent of respondents reporting a positive outlook for their company for the year ahead. This represents a significant increase in positivity compared to 2020 and 2021 surveys, when positive outlooks stood at 68.25 and 69.56 per cent respectively. In fact, more respondents reported a positive outlook for their company than in any of the previous eight years the State of the Industry survey was undertaken.

Of the remaining responses, 14.16 per cent had a neutral outlook for 2022, a slight reduction on the previous year’s 20.29 per cent, and the lowest number in the last four years, by a tiny margin. Only 0.88 per cent of this year’s respondents had a negative outlook, the same proportion as those who were uncertain what 2022 might bring. Compared to the survey for 2021, where 7.25 per cent had negative expectations and 2.90 per cent said they didn’t know, negative outlooks and uncertainty noticeably decreased.

When it comes to the effects of the COVID-19 pandemic, it appears that many respondents can finally see the light at the end of the tunnel, as the vaccine rollout continues and restrictions ease in those states where outbreaks occurred in 2021. Some contributing factors to the increased morale within the industry could include a sense that the worst of the pandemic is over, and those whose businesses survived feeling more confident in their ability to withstand any future

challenges that may arise. It’s also possible that some of those who’ve had a tough few years, yet are still active within the industry, may feel that things can only get better. There is also the possibility that some businesses that were already struggling before the pandemic have closed since previous surveys, reducing the responses from those with negative company outlooks. Respondents may also hope to reap extra business resulting from federal and state governments seeking to stimulate economic recovery through funding infrastructure projects. Some companies may already be seeing increased business as a result, or have such work lined up.

The confidence the majority of survey respondents feel about 2022 could well be influenced by the performance of their businesses over the past year. Although 2021 was a ‘pandemic year’ with disrupted international supply chains, travel restrictions and lockdowns in response to virus outbreaks in New South Wales and Victoria, respondents largely reported that their companies performed as well or better than expected.

Overall, 57.52 per cent of respondents stated that their company’s performance in 2021 met expectations, compared to 32.61 percent in 2020. Meanwhile, 28.32 per cent reported that their business exceeded expectations, compared to 24.64 per cent in 2020. The proportion of companies underperforming against expectations reduced to 14.16 per cent for 2021, from 2020’s 42.75 per cent. These results may be partly attributed to companies being able to consider the pandemic into their 2021 expectations, whereas nobody could have anticipated its impact in 2020. One respondent explained that they’d been “unsure of what would happen due to various COVID influences, but it was not as terrible as predicted for us”. Another respondent said, “We were able to keep serving our customers with few problems due to the COVID outbreak.”

Some businesses found they were able to adapt in 2021 and make changes to keep overall performance steady throughout the pandemic. “Our structure changed to meet the shifting requirements of our customers and this ensured we retained and met our goals through trying times,” said one respondent. For some, 2021 saw a shift in demand for different product and service offerings. “Some markets fell, others grew. Met overall budgets, but with different products and services than traditionally expected,” one respondent said. Whether 2021 performance met, exceeded, or fell short of expectations also varied by a company’s sectors and services, as well as its dependence on imports and exports. For instance, some respondents with a significant involvement in consulting, pump asset services and aftermarket needs found that work volume continued as expected, as essential pump systems still needed to be maintained and optimised. One respondent noted that there were still “many problems in

my field due to misunderstandings about pumps by the water/ installation engineers”.

Factors that enabled companies to exceed expectations included a skilled workforce, growth in certain sectors, projects proceeding, and being able to provide services and products that others couldn’t throughout the pandemic. “We had fantastic growth on PY in the retail domestic and farming sector,” said one respondent, while another noted that the steel company for which they provide pump services and after sales support made a “huge profit”. “Vertical integration gave us the ability to deliver when others were hampered by supply chain issues,” said another respondent.

The influence of supply chains on 2021 performance was reinforced by other responses, such as one respondent who largely attributed their company’s success to “industry growth and local manufacture and supply”.

Some respondents who found business fell short of expectations indicated that they had underestimated the longevity of the pandemic and its impact. “We expected normality to return early in 2021…” explained one respondent.

Disrupted global supply chains and project postponement were key factors for many companies, with respondents citing “delayed or cancelled projects” and “international supply and freight issues”. Others found the pandemic and travel restrictions affected their operations, especially when it came to seeing clients face-to-face. Other ongoing issues for the industry, such as export constraints and Australia’s tense relationship with China, were also cited as reducing performance for respondents over 2021, as were staffing issues.

While many respondents were optimistic about the year ahead for their own companies, there remained more uncertainty when it came to the outlook of the industry as a whole for 2022.

This uncertainty is reflected in the 19.47 per cent of respondents who were unsure about how they expected the industry to perform, similar to the 20.29 per cent last year. Still, a 62.83 per cent majority of respondents reported a positive outlook for the industry, an increase on 52.17 per cent in the previous survey. Meanwhile, 16.81 per cent of respondents saw a neutral industry outlook for 2022, somewhat less than in the last four years. Negative outlooks for the industry dropped to 0.88 per cent, compared to 4.35 per cent last year, and represented a historic low for the survey.

The year that was: 2021 industry performance by vertical

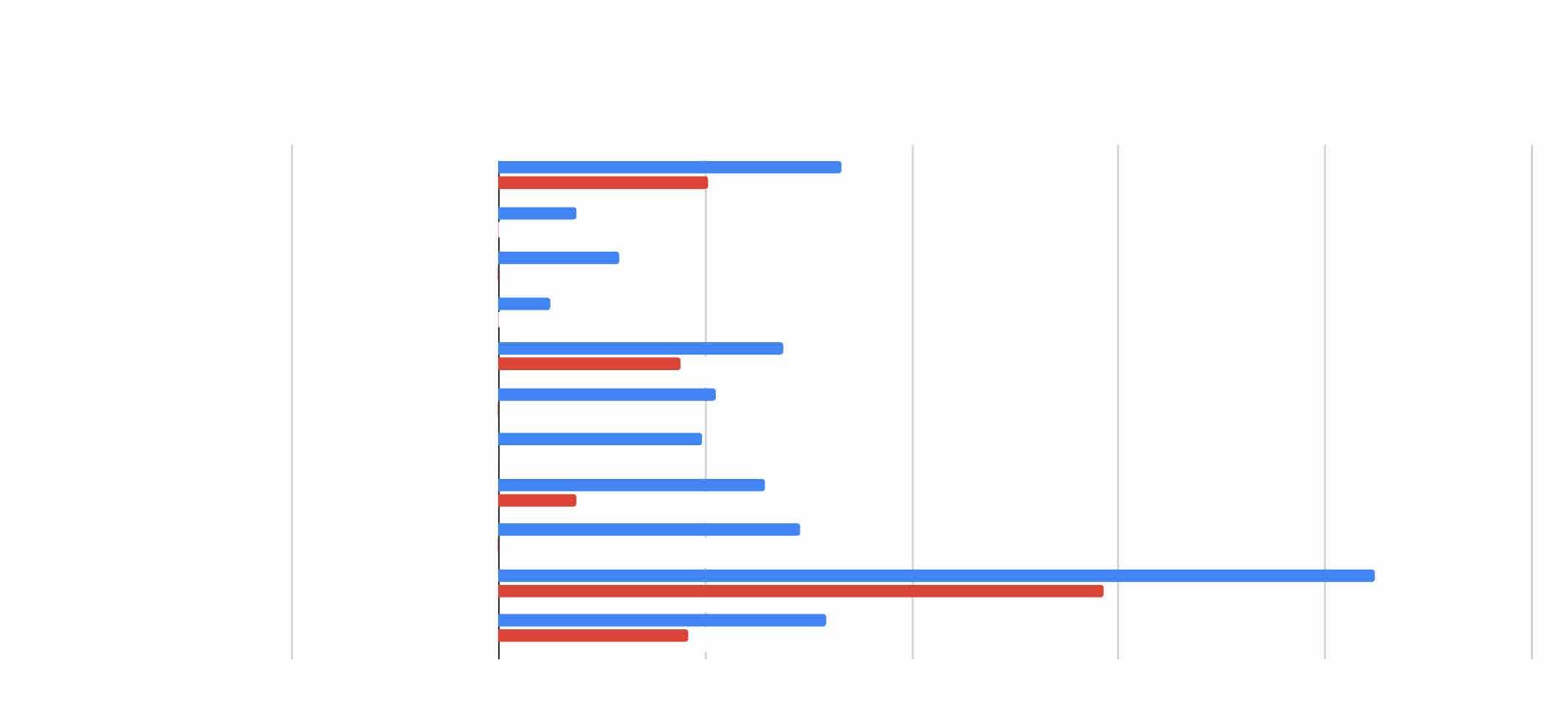

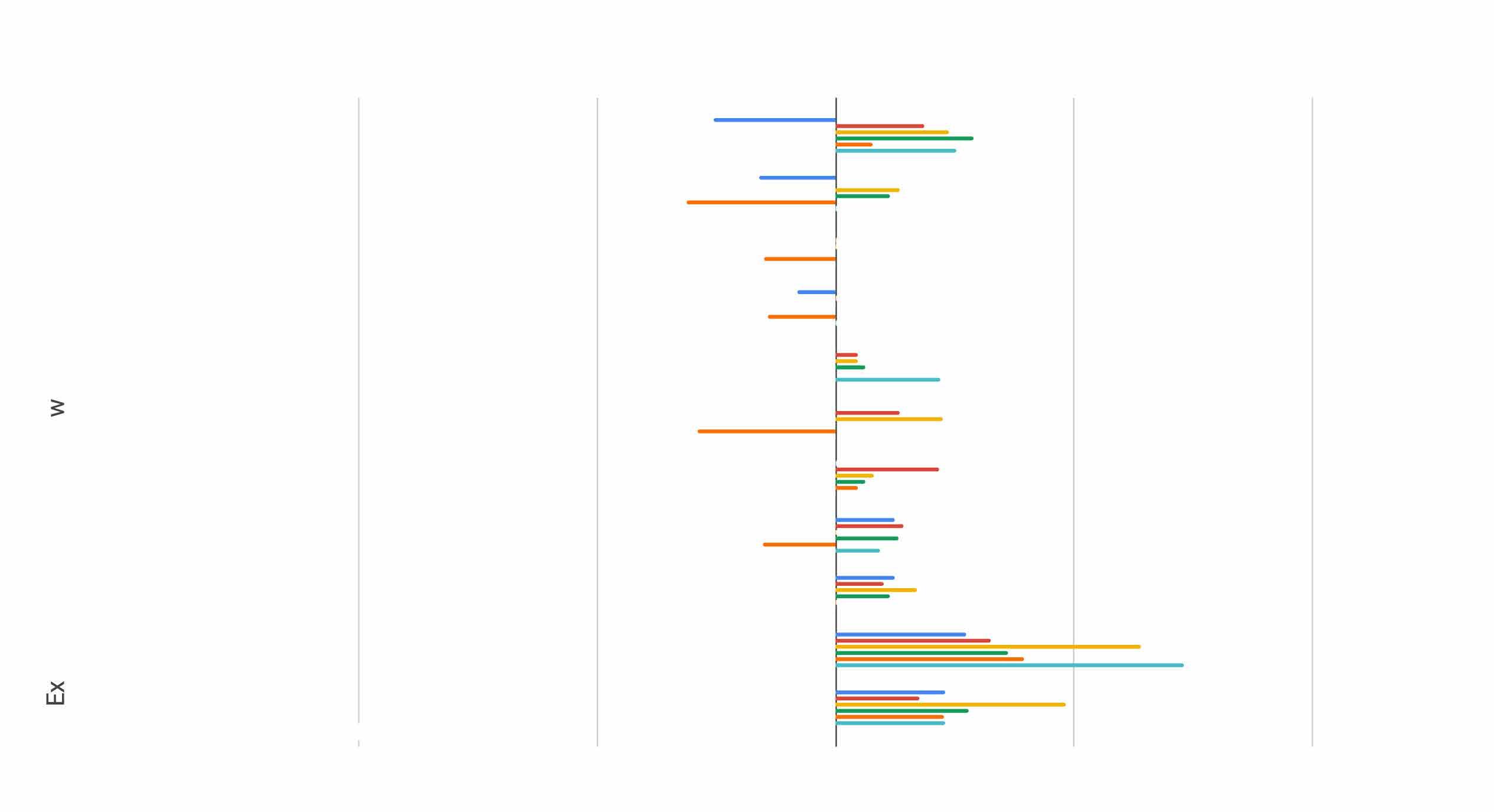

Key to understanding the current state of the industry is evaluating sector performance over the last 12 months. Once again, we asked respondents about the volume of work experienced over key verticals throughout the year, then compared these responses to data about how each sector was expected to perform in 2021 from the last time the survey was completed.

It is important to note that the expectations from the previous year were based on the assumption that the COVID-19 situation at the end of 2020 (low to no community transmission and most state borders open to each other) would be maintained, which did not turn out to be the case. This may explain why none of the verticals performed as well as expected through 2021.

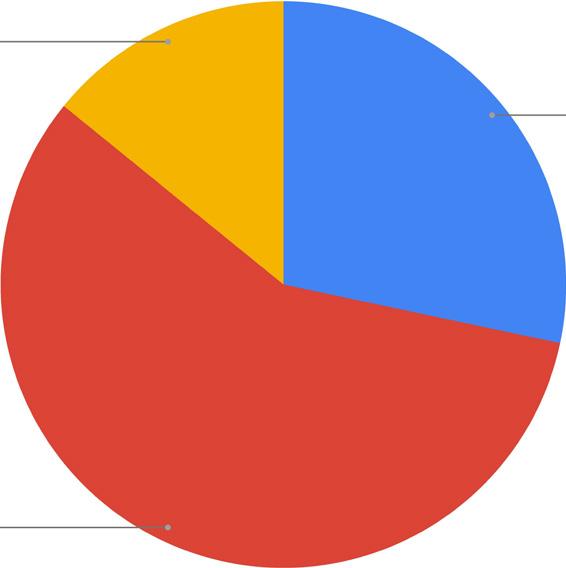

According to respondents, water and wastewater, mining, irrigation, and chemicals and pharmaceuticals sectors performed the best in 2021. As depicted in Figure 6, the frontrunners were water and wastewater, followed by mining, which respondents predicted. The worst performing sectors were pulp and paper, manufacturing, and food and beverage, where work volumes slightly decreased overall, contrary to the previous year’s expectations. Meanwhile, work in the power generation sector neither increased nor decreased. The sectors that experienced growth throughout 2021 were largely those that were considered essential services, reducing the impact of the pandemic and resulting mitigation

Expected vs. reported growth across industry sectors for 2021

measures on their operations. On the other hand, the sectors where work volumes shrunk, such as food and beverage, were those that may have been more heavily affected by various pandemic-related factors such as work-from-home orders, reduced retail spending, supply disruptions, and the shutdown of the hospitality and retail industries in states experiencing outbreaks. Some of the general trends in sector performance over recent years can be seen in Figure 7.

Continuing the more optimistic theme of 2020’s survey results, respondents expect some magnitude of growth in almost all sectors over 2022. The one exception was plastics and rubber, where they expect work volumes to neither increase nor decrease. The verticals expected to perform the best throughout the year are once again water and wastewater, mining and irrigation. Chemicals and pharmaceuticals is also

expected to experience similar growth to that of 2021. Oil and gas, pulp and paper, manufacturing, power generation, building services and HVAC, and food and beverage are expected to perform significantly better than they did in 2021.

survey. Nevertheless, 60.27 per cent of respondents agreed that the pandemic would continue to have significant lingering negative effects on the industry throughout 2022.

Some of the main impacts the pandemic had on respondents throughout 2021 included project postponement or cancellation, freight and supply chain difficulties, staffing issues, and difficulties accessing work sites. According to one respondent, “COVID has meant that a lot of food and beverage, and water sector clients are restricting access to their sites, so projects are being deferred”. Another stated that over 2021 “delays in oil and gas projects due to COVID had the biggest negative impact” on their business. “Global supply chain disruption has had an effect on both supply and pricing,” said one respondent. Another respondent described the “significant impact caused by global supply chain disruption, basically longer lead times for all goods”.

A smaller number of respondents had a more positive spin on the pandemic’s effects, citing that their businesses had benefited from factors such as “delays in deliveries from competitors,” such as manufacturers based in China.

shaping the industry?

A multitude of different global and national factors play into the performance of Australia’s pump industry at any time. The State of the Industry survey asked respondents about some of the key factors that affected industry performance throughout 2021, and those expected to play the biggest role in shaping the industry in 2022. Due to the diverse sectors and businesses within the pump industry, various events or trends affect different industry participants differently. As a result, opinions varied as to which factors respondents considered the most significant, and in some cases, what some respondents saw as a positive was a negative for others. The bumpy road back from COVID-19

The COVID-19 pandemic continued to affect all facets of industry throughout 2021, both locally and globally. The level of restrictions pump industry participants had to contend with locally varied considerably by the outbreak status of the states and territories in which they operated, supply chains were disrupted globally, and international travel remained largely off the cards. With Australia’s vaccine rollout now progressing and restrictions easing within Victoria and New South Wales, respondents were generally more hopeful than in the previous

As 2021 drew to a close, respondents noted that COVID-19 was “tending to have less impact on day-to-day operations,” but certain impacts were likely to remain key issues for the industry for some time. In particular, respondents expected the supply chain, freight and pricing effects to linger. “The impact will continue in 2022, probably throughout the entire year. Increases in raw materials pricing, shipping cost increases, and material supply will be big issues in 2022,” said one respondent. Another said, “I believe that this will continue in the short term but will level out over the next 18 months as the world gets back to normal business”. However, as one response stated, an awareness of the likely longevity of some pandemic impacts will enable industry participants to “be better prepared” to meet the challenges they pose.

With Australia gradually opening back up, respondents were generally feeling positive about the prospects of increased work driven by postponed projects getting back underway, and new projects beginning over 2022. As one respondent summarised, “Projects are starting to move now and should open up in 2022.” Overall, 67.12 per cent of respondents believed that the amount of major projects underway and being approved would be one of the biggest positives of 2022.

The mining and natural resources sectors have been key drivers of industry growth over recent years. In 2020 the pandemic hit the mining industry with significant pricing volatility and associated cash flow and liquidity issues, and these continued throughout 2021. Despite this, it remained one of the best performing sectors for the year and is expected to rebound and continue to drive significant growth in 2022.

Of the survey respondents involved in the mining sector, 45 per cent reported that work volumes remained steady over 2021, 22.5 per cent said they somewhat increased, and 17.50 per cent reported that they increased significantly. Only five per cent of respondents found a significant decrease in work in this sector, and ten per cent found they somewhat decreased.

According to Trevor Hart, Global Mining Leader at KPMG, while the pandemic increased risks associated with supply instability and economic downturns, it has also prompted enormous stimulus spending in most major economies.

“We’ve seen not just a spike in prices for iron ore but more broadly government stimulus and supply interruptions caused by COVID-19 has been driving up prices for commodities,” said Mr Hart. “Volatility in global markets has also seen investors flock to safe havens, driving strong precious metal prices, such as gold. This is not just a commodities story. COVID-19 also seems to have accelerated the focus on climate change and efforts to decarbonise.”

According to the September 2021 Resources and Energy Quarterly published by the Department of Industry, Science, Energy and Resources, export earnings reached a record $310 billion during the 2020-2021 financial year. Iron ore export earnings reached a record $153 billion over this period, thanks to a strong demand from China and restricted market supply from Brazil due to COVID-19-related workplace issues. However, in the second half of 2021, prices declined from the highs of over US$230 a tonne seen in May. This can largely be attributed to falling domestic demand for steel in China and the Chinese government’s efforts to limit the country’s 2021 steel output to 2020 levels, and ramping up of a number of key government policies to limit energy use and emissions. A rebound occurred in late-November to early-December as steel output restrictions were somewhat relaxed and production in China’s steel mills increased.

Likewise, steel prices experienced a number of significant surges and declines over 2021, due to factors including changes in Chinese domestic demand for construction projects and production restrictions being tightened or loosened.

Coal exports were impacted by import restrictions as a result of tensions with China, although there was growing optimism about resuming trading towards the end of the year, after data reported that small amounts of Australian coal had cleared borders in October. However, a volatile relationship with China is likely to continue to impact trading opportunities in an array of industries, with words exchanged between governments as 2021 drew to a close.

The Department of Industry, Science, Energy and Resources states that the outlook for Australia’s mineral exports remains