Upgrading and expanding Melbourne’s wastewater infrastructure

New isolation and air valves FOR MACKAY

State of the Industry 2023: WHAT’S IN STORE?

Upgrading and expanding Melbourne’s wastewater infrastructure

New isolation and air valves FOR MACKAY

State of the Industry 2023: WHAT’S IN STORE?

Polymaster’s unique Enclosed IBC Bund solves many of the problems associated with IBC storage and chemical/fluid decanting in a weather resistant, purpose-built enclosure.

Æ Full weather protection – stops rain entering the enclosure

Æ Easy forklift loading with wide forklift access from both side and back

Æ 250ltr day tank

Æ Lockable cabinet to keep system secure

Æ Venting by two sides

Æ Viewing windows incorporated into the doors

Æ 110% bund capacity complies with AS3780

Æ Sight tube and low-level alarm available

Æ Chemical resistant – high grade polyethylene construction

Hello all and welcome to the Summer Edition of Pump Industry Magazine. I notice temperatures starting to climb already, now just waiting for the humidity to arrive here in Brisbane.

As we draw to the end of another year, we all ponder on what 2023 might look like for our Industry. We are a very diversified group which includes mining, oil and gas, energy, chemicals, municipal, water and wastewater treatment, industrial, irrigation, horticulture, fire protection, and building services to name just a few ranging from large multimillion dollar projects right down to small household pumps.

Currently we continue to see pent up demand for our services and products across all sectors bolstered by government infrastructure and private investment spending. In talking to colleagues at our recent AGM, it seems the order books continue to fill with work extending well into 2023 which augurs well for the industry.

that allows a person in Queensland to exclusively service, repair and maintain pumps without a Plumbers Licence.

PIA has petitioned the Department of Energy and Public Works to review this anomaly, asking for a special dispensation for PIA Members. We understand the issue was tabled at the Services Trade Council (STC) meeting on 30 November.

The STC was established under the PD Act 2018 to provide a voice for the service trades and to protect the public’s health and safety and the environment. The STC promotes and enhances the QBCC’s licensing of plumbing and drainage tradespeople.

We await the outcome of the STC meeting, which hopefully will provide a way forward; how this might manifest itself remains to be seen. PIA would like to see some form of concession, regulatory change or maybe the creation of a new Pump Service Licence based on experience, competency, knowledge of pump systems, best practice etc.

Pump Industry Australia Incorporated C/-340, Stuarts Point Road Yarrahapinni NSW 2441 Australia Ph/Fax: (02) 6569 0160 pumpsaustralia@bigpond.com www.pumps.org.au

PIA Executive Council 2023

John Inkster – President Brown Brothers Engineers

James Blannin – Vice President De.mem – Stevco

Kevin Wilson – Treasury/Secretary Executive Officer

Alan Rowan – Councillor Executive Officer – Publications and Training, Life Member

Ken Kugler Executive Officer – Standards, Life Member

Steve Bosnar – Councillor Franklin Electric/Pioneer Pumps

Geoff Harvey – Councillor Irrigation Australia

Joel Neideck – Councillor TDA Pumps

Jamie Oliver – Councillor Grundfos Pumps

Mat Arnett – Councillor Ebara Pumps

Michael Wooley – Councillor Tsurumi Pumps

Billie Tan – Councillor Regent Pumps

Is this the "calm before the storm" before the northern hemisphere "headwinds" come our way? Maybe, but my belief is that our industry is well positioned to “weather the storm” such is the continuing need and demand for our resources both in agriculture and mining.

In mining we can expect to see large offshore investment in the search for alternative supplies of rare earths. Australia is the world's fourth largest producer of rare earths, holding 3.4 per cent of the world's resources.

So in spite of growing inflation and higher interest rates, and while we expect economic growth to slow below trend in the second half of the year, the strength of the labour market with a low unemployment rate we may only experience a soft recession. Let’s hope this is the case.

At our AGM on 14 November, your PIA Council was reelected to serve another year. We are privileged to serve the pump industry community and will continue to work for you as best we can.

There were 66 attendees at the AGM including those who attended via Zoom courtesy of Monkey Media.

The dinner afterwards was well attended with over 80 Members and colleagues enjoying the splendid facilities and views on offer at the Commonwealth Golf Club in Oakleigh. It was a cold windy day but there were a few hardy individuals out there defying the Melbourne weather.

A topic that received significant discussion at the AGM was the ongoing dialogue with the Queensland Department of Energy and Public Works where under the PD Act 2018 there is no Class of Licence or Restricted Licence

The findings of the STC are of extreme importance to all of you because if left unaddressed it could have a significant bearing on business with very high fines potentially being applicable. That said the dialogue to date has been constructive and it is hoped we will have an opportunity to discuss the matter further in the New Year.

Also of interest to Members but not raised at the AGM is the mystery around the Regulatory Compliance Mark (RCM) regarding the electrical classification of submersible pumps whereby they will move from a Level 1 low risk device to a Level 3 device. The RCM is a trademark owned by the electrical operator that represents compliance with the Electrical Equipment Safety Scheme (EESS). For electrical safety, in scope electrical equipment cannot be sold unless the item is marked with the RCM in compliance with AS/NZS 4417.1 and 2.

PIA is seeking further clarification with the EESS regarding the matter and its application

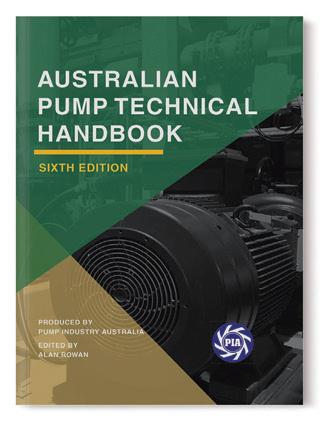

And just a reminder to you all that the Pipe Friction Handbook has been updated and that the 6th Edition of the Pump Technical Handbook was released in September with 40 per cent more content; a must have on your desk or library.

I take this opportunity to welcome back our Councillors, Secretary/ Treasurer, Executive Officers and Monkey Media as our Marketing and Communications Partner.

Thank you for your continued support of Pump Industry Australia.

Wishing you all a safe and happy Xmas and New Year and a prosperous 2023.

John Inkster – President

Scan to subscribe to Pump Industry Magazine’s weekly newsletter – delivered to your inbox every Thursday afternoon.

ABN: 36 426 734 954

C/- The Commons, 36–38 Gipps St, Collingwood VIC 3066 P: (03) 9988 4950 monkeymedia�com�au info@monkeymedia�com�au pumpindustry com au magazine@pumpindustry com au

Managing Editor: Lauren Cella

Assistant Editors: Rebecca Todesco, Stephanie Nestor

Journalist: John Thompson

National Media and Events Executives: Rima Munafo, Brett Thompson, Christine Circosta

Design Manager: Alejandro Molano

Senior Designer: Luke Martin

Designers: Ozlem Munur, Danielle Harris

Marketing Manager: Radhika Sud

Marketing Associate: Andie James

Digital Marketing Assistants: James Holgate, Jackson Barnes, Natalie Ta

Publisher: Chris Bland

GM Growth and Strategy: Laura Harvey

ISSN: 2201-0270

This document has been produced to international environmental management standard ISO14001 by a certified green printing company.

This magazine is published by Monkey Media in cooperation with the Pump Industry Australia Inc. (PIA). The views contained herein are not necessarily the views of either the publisher or the PIA. Neither the publisher nor the PIA takes responsibility for any claims made by advertisers. All communication should be directed to the publisher.

The publisher welcomes contributions to the magazine. All contributions must comply with the publisher’s editorial policy which follows. By providing content to the publisher, you authorise the publisher to reproduce that content either in its original form, or edited, or combined with other content in any of its publications and in any format at the publisher's discretion.

Acontract for the construction and operation of an advanced wastewater recycling facility, to be built in Western Sydney, has been awarded by Sydney Water.

Sydney Water awarded the contract for the Upper South Creek Advanced Water Recycling Plant (AWRC) to a consortium of John Holland, TRILITY, GHD and Jacobs

Operating at full capacity, the facility will treat around 70ML of wastewater each day and produce high-quality treated water for sustainable use in homes and businesses across Western Sydney, and biosolid products for use in agriculture.

Sydney Water Managing Director, Roch Cheroux, said the plant is an important piece of infrastructure for the region and will leave a positive legacy for the communities of Sydney.

“AWRC will produce high-quality water suitable for a wide range of non-drinking uses for homes, businesses, industrial sites, agriculture and for the watering of public open spaces,” Mr Cheroux said.

The world-class facility will be located between Kemps and South Creek and service the Aerotropolis and Western Parkland City.

John Holland will be responsible for the design and construction. GHD and Jacobs will provide engineering and design services, while TRILITY will provide operations and maintenance advice as the project is delivered.

In a joint venture with John Holland, TRILITY will be responsible for the operations and maintenance of the facility for up to ten years once completed.

John Holland’s General Manager of Water and Optimisation, Margaret Riley, said she’s thrilled to continue a long-term

left) TRILITY

Francois

collaboration with Sydney Water alongside partners TRILITY, GHD and Jacobs.

“It’s exciting to launch a project with such industry leading circular economy ambitions and Sydney Water is to be congratulated on its vision,” Ms Riley said.

TRILITY’s Managing Director, Francois Gouws, echoed the sentiments of its joint venture partner.

“It’s a real privilege to be working in collaboration with Sydney Water and alongside our partners John Holland, GHD, and Jacobs on such an exciting project, and one with motivations to drive innovation and a circular economy,” said Mr Gouws.

The Upper South Creek Advanced Water Recycling plant is due to be operational in 2026.

Kelair Pumps Building & Fire Division is one of the most technically-competent suppliers in Australia. We can provide a complete range of fire sprinkler pumpsets for all applications, fully compliant to technical specificiations.

- Purpose built to individual requirements

- Compact, pre-fabricated, complete packaged solutions

- Fully tested to AS2941/ISO9906 and pre-commissioned

- Turnkey installation saves time and labour costs

- Simple to mobilise and transport

- Routine maintenance packages also available

We know the importance of choosing the right equipment to match your process. With our extensive range of pumps, first class customer service and ongoing comprehensive support, Kelair Pumps are second to none when it comes to your pumping requirements.

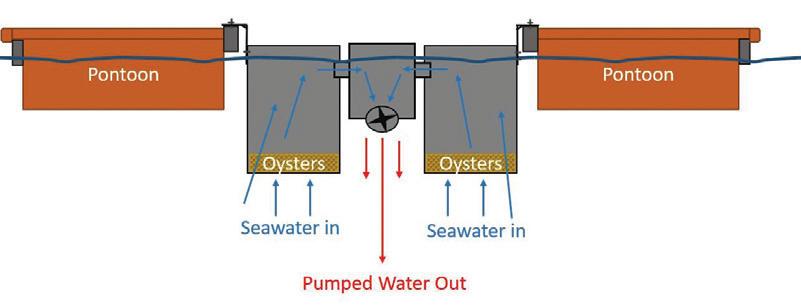

The New South Wales Resources Regulator issued a safety alert after a maintenance contractor had to swim to shore when a pontoon pump overturned and sank his boat.

The contractor was working at Ravensworth coal handling processing plant (CHPP) in the New South Wales Hunter Valley when tasked with servicing a pump on a pontoon on 17 August 2022.

The worker used a boat to access the pontoon.

The pontoon and pump configuration had a dry weight of about 15.7t and a wet weight (fuel/water in pump line) of about 17t. The pontoon had a cube container filled with water on one side as a ballast control.

While carrying out the service, the worker identified that a pulley on the primer pump (vacuum) was faulty.

He had taken off his floatation device to carry out his work, as it was not required by the mine operator.

The primer pump was removed while draining the water line and put into the boat.

The subsequent change in the centre of gravity of the whole unit caused the pontoon to overbalance and overturn.

Within minutes, the worker noticed the pontoon tilt and jumped in the water to swim 30m to the bank, without a floatation device. The pontoon then overturned and dragged the boat under the water with it.

Fortunately, the worker was not injured.

Initial investigations by the mine operator identified:

1. The site standard for working on or near water was not complied with

• Verify awareness of the roles and responsibilities for maintaining compliance to their site’s standards for working on or near water

• Review the use of work authorisation standards

• Review safe work systems for this type of task considering:

» The requirement for wearing flotation devices on pontoons

2. The work authorisation for pump maintenance did not identify any additional controls associated with a body of water

3. No operational risk assessment was in place that identified the flotation characteristics of the pontoon and pump

The New South Wales Resources Regulators recommends that mine operators should:

» The requirement for a spotter while undertaking maintenance activities on water

» Emergency response capability around water

» The suitability of boats for transporting workers and equipment

• Consider building a jetty for longterm access to pumps on dams

The Sunshine Coast utilised a technique never-beforeseen in the area to help replenish Maroochydore Beach, importing sand from Moreton Bay and placing it in the water, about 300m off the beach.

The project – which was expected to commence in November – deployed a method called nearshore nourishment, which involves a dredge that will collect sand from the Spitfire Channel and transport it to Maroochydore Beach for release, potentially using two techniques.

One technique may include dropping the sand from the bottom of the barge and the other will spray the sand in a rainbow shape into the water, with the results of both methods then being compared.

It was hoped that waves, currents and tides would then deposit the sand onto the beaches providing an additional buffer against future storms and coastal erosion.

Strict safety measures were in place on the beach and in the water during the trial for the public’s protection, and visitors to the area were asked to follow council and lifeguard instructions.

Sunshine Coast Council’s Environment Portfolio Councillor, Peter Cox, said the Coastal Hazard Adaptation Strategy guided Council’s work to manage the region’s beaches from the risk of future coastal erosion.

“A lot of work has gone on behind the scenes over several years to inform the long-term management of our coastline,” Mr Cox said.

“We are using coastal data captured through wave buoys, beach surveys, hydrographic surveys, ecological monitoring, and wind data to shape the project.

“This is in addition to studies that have shown there is a limited supply of sand on the Sunshine Coast.”

Mr Cox said Maroochydore Beach had been subject to significant erosion events over the years and adding new sand from outside the region – such as the Spitfire Channel in Moreton Bay – could help nourish the area and protect it from further erosion.

“The trial will supplement the existing sand renourishment program that involves collecting sand from the Maroochy River and pumping it onto the beach,” Mr Cox said.

“The trial will provide critical evidence to support our understanding of how this technique works here on the Sunshine Coast.”

Mr Cox said although this technique had not been used on the Sunshine Coast, it was a well-established method and had proven to be successful for other government bodies on the Australian east coast, including the Gold Coast.

“We expect the trial will show that additional sand placed in the nearshore area, close to the sand bar, will naturally migrate to the shoreline over time,” Mr Cox said.

“This will confirm the effectiveness of this well-established methodology to enable us to use it in the future if we need to.”

Sunshine Coast Council has established a technical advisory group to act on behalf of the community and contribute to the project, with members including Sunshine Coast Council officers and councillors, Queensland Government representatives, Surf Lifesaving Queensland, Queensland Police Service and expert engineering consultants.

All necessary environmental approvals are being progressed for the trial to be conducted.

For answers to frequently asked questions about the trial, please visit Council’s website and search for ”Maroochydore nearshore beach nourishment trial”.

A$400,000 investment by the Western Australian Government will support the construction of three community desalination units, built to test new desalination technologies for improved climate resilience and sustainability in community water supplies.

A brackish water desalination unit will be installed in Katanning during summer 2022-23, as part of a network of demonstration sites to examine how the technology can help overcome seasonal variability, reduce reliance on scheme water and support community development.

The Katanning unit will supply 30kL per day of fresh water to augment services for three local parks, as well as other town infrastructure.

This summer a 100kL/day desalination unit will be installed at Merredin to service farm and town water needs, while a new 10kL/day salty groundwater system at Dumbleyung will service farm and town water supplies, as well as underpin repairs to the town’s swimming pool.

A further 30kL/day brackish water off-grid reverse osmosis unit will be installed at the Wongutha Christian

Aboriginal Parent-Directed School at Esperance, as part of a collaboration with the Australian Government’s National Water Grid Authority.

Western Australia’s former Minister for Water, Dave Kelly, said long-term statistics indicated an urgent need for diversified water sources.

“This important work, supported by Water Corporation, will help to serve not only these first three communities but others in the future, as the technology is better understood and adopted throughout the state,” Mr Kelly said.

The project received funding from the state’s WaterSmart Farms initiative, and is led by the Department of Primary Industries and Regional Development in partnership with Water Corporation.

Western Australian Minister for Agriculture and Food, Alannah MacTiernan, said the trial project would further support primary producers’ growing interest in desalination technologies.

“This initiative is assisting our farmers and communities to build resilience in dry years by undertaking scientific research on how best to apply this technology to tap into benefits for rural businesses and the regions,” Ms MacTiernan said.

“While recent rainfall in the agricultural region has been favourable, now is the time to invest in how to future-proof farming operations and regional communities so they are set up and well-resourced to manage the dry years.

“The greater use of groundwater can also help lower the water table and reduce salinity.”

Lowara’s Smart Pump range is all about the right combination of motor, variable speed drive and pump. For top efficiency, ensuring reliable performance, maximum savings and a rapid return on investmentyou need the Lowara Smart Pump range.

Contact us to find your smart pumping solution. Featuring an integrated intelligent pumping system with an electronically driven, permanent magnet motor and an embedded electronic drive, these simply smart pumps will greatly enhance system performance and maximize flexibility.

Following 18 months of work, a team of engineers from the University of New South Wales (UNSW Sydney) has successfully converted a diesel engine to run as a hydrogen-diesel hybrid engine, meaning existing diesel engines can run using 90 per cent hydrogen as fuel.

Led by Professor Shawn Kook, the team from the School of Mechanical and Manufacturing Engineering developed the Hydrogen-Diesel Direct Injection Dual-Fuel System, reducing CO2 emissions by more than 85 per cent in the process.

Green hydrogen, which is produced using clean renewable energy sources such as wind and solar, is much more environmentally friendly than diesel.

The researchers said that any diesel engine used in trucks and power equipment in the transportation, agriculture and mining industries could

ultimately be retrofitted to the new hybrid system in just a couple of months.

The UNSW Sydney team’s solution to the problem maintains the original diesel injection into the engine, but adds a hydrogen fuel injection directly into the cylinder.

The collaborative research, completed with Dr Shaun Chan and Professor Evatt Hawkes, found that specifically timed hydrogen direct

injection controls the mixture condition inside the cylinder of the engine, which resolves the problem of harmful nitrogen oxide emissions that have been a major hurdle for commercialisation of hydrogen engines.

“If you just put hydrogen into the engine and let it all mix together you will get a lot of nitrogen oxide (NOx) emissions, which is a significant cause of air pollution and acid rain,” Mr Kook said.

“But we have shown in our system if you make it stratified – that is in some areas there is more hydrogen and in others there is less hydrogen – then we can reduce the NOx emissions below that of a purely diesel engine.”

Importantly, the new HydrogenDiesel Direct Injection Dual-Fuel System does not require extremely high purity hydrogen which must be used in alternative hydrogen fuel cell systems and is more expensive to produce.

Member Custom Editions Available

Complete review & update

• Three new chapters – Installation, Commissioning and Operations

• Completely rewritten Slurry Pumping and Energy Efficiency chapters

• 80 additional pages

Compared to existing diesel engines, an efficiency improvement of more than 26 per cent has been shown in the diesel-hydrogen hybrid, achieved by independent control of hydrogen direct injection timing, as well as diesel injection timing, enabling full control of combustion modes –premixed or mixing-controlled hydrogen combustion.

The research team hopes to be able to commercialise the new system in the next 12 to 24 months and is keen to consult with prospective investors.

They say the most immediate potential use for the new technology is in industrial locations where permanent hydrogen fuel supply lines are already in place.

That includes mining sites, where studies have shown that about 30 per cent of greenhouse-gas emissions are caused by the use of diesel engines in such items as mining vehicles and power generators.

“At mining sites, where hydrogen is piped in, we can convert the existing diesel engines that are used to generate power,” Mr Kook said.

“In terms of applications where the hydrogen fuel would need to be

stored and moved around, for example in a truck engine that currently runs purely on diesel, then we would also need to implement a hydrogen storage system to be integrated into our injection system.

“This new technology significantly reduces CO2 emissions from existing diesel engines, so it could play a big

Running an optimised and sustainable mining and mineral processing operation has never been so important with pressures on water availability, rising costs and environmental regulations becoming stricter.

Water conservation is vital in countries such as Australia, the driest inhabited continent in the world, and good water management reduces disruption to mining operations as well as damage to the environment.

Using reliable and efficient peristaltic pump technology from Watson-Marlow Fluid Technology Solutions (WMFTS) for mining procedures can produce water savings of 71% in comparison with typical centrifugal pumps.

Bredel hose pumps from WMFTS can be considered water-saving devices in their capabilities, such as being able to handle undiluted tailings and thickener underflow with up to 80% solids. Since Bredel hose

pumps do not have seals, it eliminates the requirement of water for flushing, to treat process wastewater and provide pump service water.

A reduction in water usage also delivers associated benefits through lower chemical usage and energy required for the treatment of process wastewater. Pumps must be capable of high operating pressures and flow rates to ensure a smooth liquid passage and deny the opportunity for the product to settle. Bredel hose pumps are self-priming to 9 metres, can run dry safely and can meter accurately to ±1%.Reducing water usage is better for the environment too, as less storage is needed for tailings and the number of basins can be minimised.

The wear-free performance of clog-free peristaltic pumps also means the need for routine maintenance and spare parts is reduced greatly.

part in making our carbon footprint much smaller, especially in Australia with all our mining, agriculture and other heavy industries where diesel engines are widely used.”

The Australian market for dieselonly power generators is currently estimated to be worth around $765 million.

A paper published in the International Journal of Hydrogen Energy by Mr Kook’s team shows that using their patented hydrogen injection system reduces CO2 emissions to just 90g/ kWh – 85.9 per cent below the amount produced by the dieselpowered engine.

“Being able to retrofit diesel engines that are already out there is much quicker than waiting for the development of completely new fuel cell systems that might not be commercially available at a larger scale for at least a decade,” Mr Kook said.

“With the problem of carbon emissions and climate change, we need some more immediate solutions to deal with the issue of these many diesel engines currently in use.”

Bredel hose pumps have a corrosionresistant enclosure which suits arduous mining environments

MORE INFORMATION

For more information on how peristaltic pump technology can deliver significant water savings for mining and water treatment companies, go here: wmfts.com/en/mining/

Find out more today

+61 2 8787 1400 Fluid Technology Solutions

Following two years of virtual events, Pump Industry Australia (PIA) Members were once again able to meet face to face at the 19th annual AGM, held at the Commonwealth Golf Club in Melbourne. The first in-person AGM since 2019 boasted a great turnout, with a sizable crowd gathering to hear how the industry had fared over the last 12 months and to see what was in store for the coming year.

For those unable to attend, the event was run virtually as well, with attendees from all over the country – and even one from New Zealand –able to tune in, access presentations and engage.

PIA President, John Inkster, started by welcoming everyone to the event and encouraging attendees to reflect on the difficult and turbulent times many families and businesses had faced over the past few years.

Despite being once again able to conduct an in-person AGM, Mr Inkster mused that the pump industry – and indeed the world – had not seen the last of COVID-19, with variants and sub variants continuing to wreak havoc on supply chains, and a looming, eminent fourth wave of the virus expected for Australia.

Mr Inskter said that although many had thought 2023 would be different, it was shaping up to be a year not too different to 2022, referencing the ‘new

normal’ that individuals and businesses would have to adjust to.

Despite COVID-19’s ongoing presence, it wasn’t all doom and gloom; throughout the industry people had been experiencing pent up demand for products and had full order books.

An abundance of public restructuring spending and private investment meant the industry was having no problems getting cash flow in – a trend Mr Inkster predicts will continue until the fourth quarter of 2023.

However, Mr Inskter warned that this cash influx may be the calm before the storm, and that despite some headwinds coming for the pump industry in 2023, Australia was in a strong position to weather the storm well.

Since 2021’s AGM, the PIA has been continuing to engage with the industry, including holding the Energy and

Efficiency of Pipelines Training online in November 2021.

The Pump Performance and Monitoring Training was also held online in March 2022 and boasted a great turnout.

In September 2022, ABB presented the Flow Meter Seminar, which was hosted by Brown Brothers Engineers in Keysborough, where attendees were given the option of attending in person or via Zoom.

On the topic of Council’s submission to the Services Trades Council (STC) regarding its request for suitably qualified Members to undertake repairs and service under the PD Act 2018, the PIA said it continues to liaise with associated parties throughout the year.

Further dialogue between the PIA and Acting Manager of Building Policy at the Department of Energy and Public Works, Elanor Ketter, was scheduled for 30 November 2022, with the PIA hoping to reach a resolution.

The PIA has been continuing its involvement with three committees on Australian standards, including with the longest running committee, the Fire Pump Committee.

AS2941 - Fixed fire protection installations - Pumpset systems

Although the committee is currently inactive, the PIA thinks it’s time this system was updated, with the current one from 2013. PIA is currently assisting Fire Protection Association Australia to write a Proposal to Standards to have the standard analysed and revised, and hopes something will come of this in 2023.

AS5414 - Bushfire water sprays system

A document was released, containing specifications for residential bushfire pumps, to which the PIA suggested it be included in the Fixed Fire Pump standard but as it stands, it is just in abeyance.

ISO 9906:2012 Rotodynamic pumpshydraulic performance acceptance tests grade one, two and three

In 2018, this was adopted as an Australian standard. There is currently a ballot as to whether the original standard should be amended, confirmed or withdrawn. It is the PIA’s intention to vote to Review and Amend.

ISO 2858:1975 End suction centrifugal pumps (rated 16 bar) - designation, nominal duty point and dimensions

The PIA was asked to vote on this standard again and, as some of these pumps are still manufactured in Australia, the PIA voted to confirm.

ISO 9905:1994 Technical specifications for centrifugal pumps class one

The PIA voted to abstain.

ISO 9908:1993 Technical specifications for centrifugal pumps class 111

As with above, PIA voted to abstain as it appears there is little interest in these standards overseas.

EL-058 Energy Efficiency for Swimming Pool pumps Committee

Draft AS 5352 Swimming Pool and Spa Heat pump systems

Despite highlighting that they were not in fact heat pump people and instead worked with hydraulic water pumps, the PIA was asked to stay part of the committee. The PIA made numerous comments to have the standard improved, with expected publication before the end of 2022.

AS 5102.1:2019 Performance of household electrical appliancesSwimming pool pump-units, Part 1: Measurement of energy consumption and performance

Amendments are being made as there were some errors with complicated calculations or formulae that need to be corrected. Expected publication was late 2022, if not early 2023.

Changes from the Federal Government came in the form of new regulations that replace the Voluntary Energy Rating Label program that applied to pool pumps until now.

From 1 October 2022, manufacturers, suppliers and importers of a pool pump will need to declare the minimum energy performance efficiency of in-scope pool pumps sold in Australia in accordance with the Greenhouse and Energy Minimum Standards (Swimming Pool pump-units) Determination 2021.

Additionally, the revised National Construction Code 2022 will be adopted as of May 2023, in which lead free plumbing equipment or parts in contact with drinking water is no longer acceptable. Also, air conditioning pumps

and circulators must comply with MEPs requirements.

There’s a proposal by the Australian Buildings Codes Board to Standards Australia to make a modification to the plumbing code. The proposal says that the design and installation of pumps is not covered sufficiently by the AS/NZ 3500 series, suggesting that the current provisions in the AS/NZ 3500 may be insufficient.

The proposed scope is to add a deemed-to-satisfy solution for the design of plumbing systems relating to pumps in the plumbing code.

PIA Executive Officer – Standards and Life Member Ken Kugler thinks the PIA should get heavily involved in this as there will be lots of benefits for many in the industry.

The Pump Technical Handbook has undergone major upgrades over the last two years, with chapters carefully reviewed and improved to ensure they’re relevant, up to date and easy to read. These upgrades have resulted in a content increase of almost 40 per cent.

Differences in publishing the handbooks means that PIA members now have the ability to customise either or both of the Pipe Friction Handbook and the Pump Technical Handbook, featuring their companies’ colours and logos on the cover. Members were encouraged to get in touch with the Council via email if they wanted to take advantage of the fantastic opportunity.

The PIA intends to keep up its industry engagement and continue its commitment to providing valuable training and learning opportunities for members and the industry as a whole.

Re-elected PIA President, John Inkster, said the PIA needs to grow, but that it needs to also make sure it has relevance and improves its presence.

Due to the ongoing effects of COVID-19, the 2022 PIA Council did not formulate a concrete plan for 2023, instead deciding that the 2023 Council could prepare one as the world returns to pre-COVID normal.

Mr Inskter said that although the last few years were difficult on account of not being able to do much, the coming year would present an opportunity to do more and promote the industry.

The 2022 AGM concluded with a dinner, where members were able to reconnect and once again engage face to face with each other, after two years of seeing each other through screens.

Pump Industry Australia is pleased to announce the publication of the sixth edition of the Australian Pump Technical Handbook, which is now available via its website, www.pumps.org.au.

For the past two years, the Pump Technical Handbook has undergone a major upgrade in which all chapters have been carefully reviewed and upgraded to ensure they are fully up to date and readily understood for all those reading the book – all resulting in a nearly 40 per cent increase in content�

In addition to the review, two new chapters were created based on splitting of the current Installation, Commissioning, Operation and Maintenance chapter to become three chapters as follows:

• Chapter 16 – Pump Installation

• Chapter 17 – Pump Commissioning

• Chapter 18 – Operation and Maintenance

The first two of these chapters have been upgraded and expanded to include the latest pump installation requirements, along with a complete run down of the commissioning process including the evaluation of that process The Operation and Maintenance chapter has also been expanded to cover Pump Safety, as well as the inclusion of sections detailing routine and preventative maintenance

While all chapters were fully reviewed, updated and simplified for easy reading, the following chapters underwent a more detailed upgrade:

• Chapter 5 – Selection of Centrifugal Pumps: The section on specific speed which was in Chapter 3 has been relocated here and an extra section on suction specific speed has been added

• Chapter 9 – Application and Selection of Slurry Pumps: The chapter has been completely rewritten with a more detailed logical emphasis on the process of selecting and applying a slurry pump for a specific slurry, including an example of the selection calculation

• Chapter 10 – Efficient Operation of Pump Systems: With the continuing emphasis on the need for more efficient pumping systems, this chapter has been reviewed and upgraded to take into account the latest advances in this field

• Chapter 11 – Pump Materials: In light of the major rewrite to slurry pump chapter, a section on slurry pump materials has been added to this chapter along with a full review of the standards relating to pump materials

• Chapter 13 – Intake Design: The section on the calculation of optimum sump volumes has been updated because the original was not clear and required clarification

• Chapter 15 – Pump Testing: Since the publication of the fifth edition of the Pump Technical Handbook, in 2018 the Australian Standard on pump testing was updated resulting in the need to update this chapter due to, among other things, changes in the test tolerances

• Chapter 22 – Pumping Formulae: The revamp of the slurry pump chapter with its own sample calculation is such that the sample slurry calculation shown in previous editions in this chapter is no longer required and has been deleted Due to the change in how we publish our handbooks, we are able to offer PIA members the opportunity to customise either or both the Pipe Friction Handbook and the Pump Technical Handbook with covers in their companies’ colours and logos� We would provide you the detailed sizing for you to design the cover copy as well as some small restrictions we will need you to comply with

The above is a short summary of the changes in the latest edition of the Pump Technical Handbook which we believe greatly improves the handbook as far as its technical content and readability is concerned We commend this latest edition to you

The sixth edition of the Australian Pump Technical Handbook, as well as the Pipe Friction Handbook, are available at www.pumps.org.au/publications.

Volvo Penta. Robust, fuel efficient industrial diesel engines that keep running even in the toughest conditions. Easy to install, operate and maintain. A powerful partnership you can trust all the way from the drawing board throughout the operational life of your engine. Competitively priced complete power-pack units ready for delivery Australia wide with a local support team on hand 24/7. To find your nearest dealer visit www.volvopenta.com

Ebara Pumps' new GSD close coupled EN733 motor pump has been selected as one of the primary water pumps for the new billion-dollar Festival Plaza upgrade in the heart of the Adelaide Arts and Culture precinct. The Ebara GSD range of ED coated pumps will be used on chlorinated water for the Festival Plazas new water feature.

The Festival Plaza Water Feature is one of the many new highlights and attractions that have been incorporated in this new development of public realm that connects Adelaide CBD and the riverbank

The specialist contractor who supplied the pumps and water treatment equipment for the new water feature – Total Water Resources chose the Ebara GSD pump due to its quality, proven hydraulic design and competitive pricing

The GS/GSD pumps come as standard with a high-quality electro deposition corrosion resistant coating to the ferrous static components, both internal and external making them ideally suited to treated fresh water environments

The GS/GSD range is the Ebara Corporation (Japan) new global range of EN733 water pumps and utilising the most advanced hydraulic computer software available, Ebara Engineers in Japan have been able to improve and increase the pump efficiencies of the new GS/GSD range above most other available pumps of similar design and standard on the global market The majority of the GS/GSD pump range are MEI>0 7 efficiency index with the balance MEI>0.6, an indication of the high-quality design and manufacture by Ebara

The Ebara GSD range of close coupled motor pumps and the GS range of bare shaft EN733 end suction pumps are both manufactured in component form at Ebara Corporation (Japan) owned and managed factories in South East Asia

After being assembled from these components by skilled tradesmen at the Ebara Pumps Australia facility in Melbourne, the pumps are then hydrostatically tested and inspected to our Japanese parent’s strict QA policies and procedures

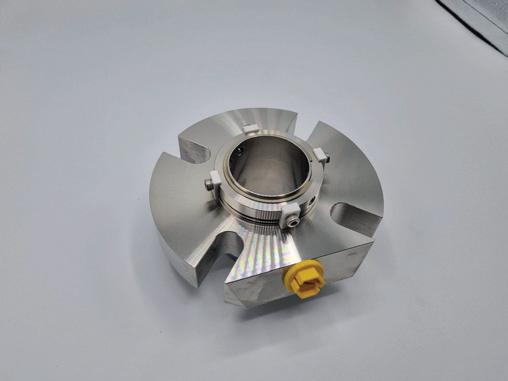

The Ebara GS/GSD range of EN733 pumps are a true 16 bar working pressure with a high grade SiC/Carbon/EPDM

Burgmann mechanical seal fitted as standard. Galvanised steel baseplates that have been fully engineered by Ebara Japan engineers are also available as an optional extra for the GSD motor pumps�

In addition to the GS/GSD range of pumps Ebara Pumps has also recently introduced the GSO range of semi open impeller ISO 2858/5199 process pumps which are also available in 304,316L and Duplex stainless steel The GSO range of pumps have been designed by Ebara Japan with a unique reverse open impeller reducing axial thrust and creating a low seal/stuffing box pressure. The pumps can be fitted with a vast range of single/double mechanical seal options and piping plans They are also available with the option of oil lubricated bearings and ANSI drilled flanges.

Ebara Corporation was founded in Japan in 1912 as a manufacturer of industrial pumps Today, as a group it consists of more than 70 companies in six continents with a workforce of more than 12,000 and with company-owned and Japanese-managed factories covering nine countries and four continents.

The huge scale of production and distribution is matched by a constant commitment to research, development and design of new products and the modern technologies for the manufacturing of them Ebara products have gained a worldwide reputation for their technology and quality

Combining over 100 years of experience with the latest computer aided design, EBARA has developed the new GS series of pumps that offer world leading performance and efficiencies.

Pumps to EN733 dimensions

16 Bar rated. PN16 flanges (24 Bar hydrostatic test pressure)

High efficiencies. MEI ³0.6 (Minimum Efficiency Index)

Mechanical seals to EN12756

Protectors to ISO13852

O’ Ring seal for casing

Cast iron components ED painted (Electro deposition painting)

The WEG W60 line motors present an excellent power density with an enhanced and robust design.

The use of modern computer programs and mathematical tools for numerical simulations and analyses optimised each component and their respective interactions.

This line is capable of speed variation and operation with frequency inverters and soft starters. The concept allows adjustments that guarantee high performance in environments with the most varied temperature ranges and comply with the most stringent criteria for efficiency, reliability and safety.

The flexibility in electrical and mechanical designs made it suitable for applications with low inrush current and high efficiency. In addition, it resulted in a reduced motor weight that will reduce base construction and installation costs.

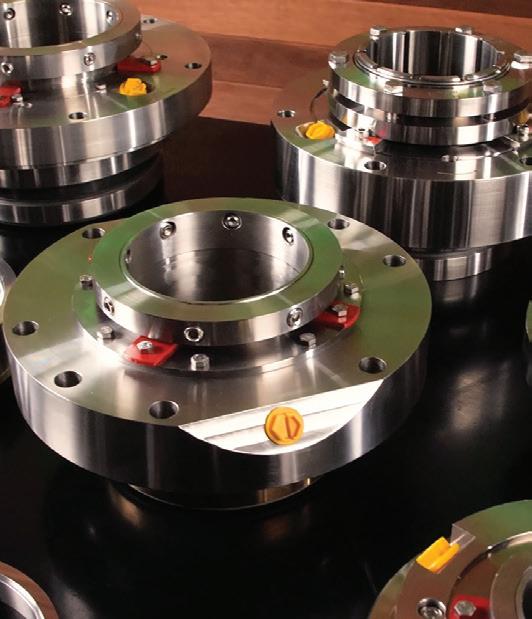

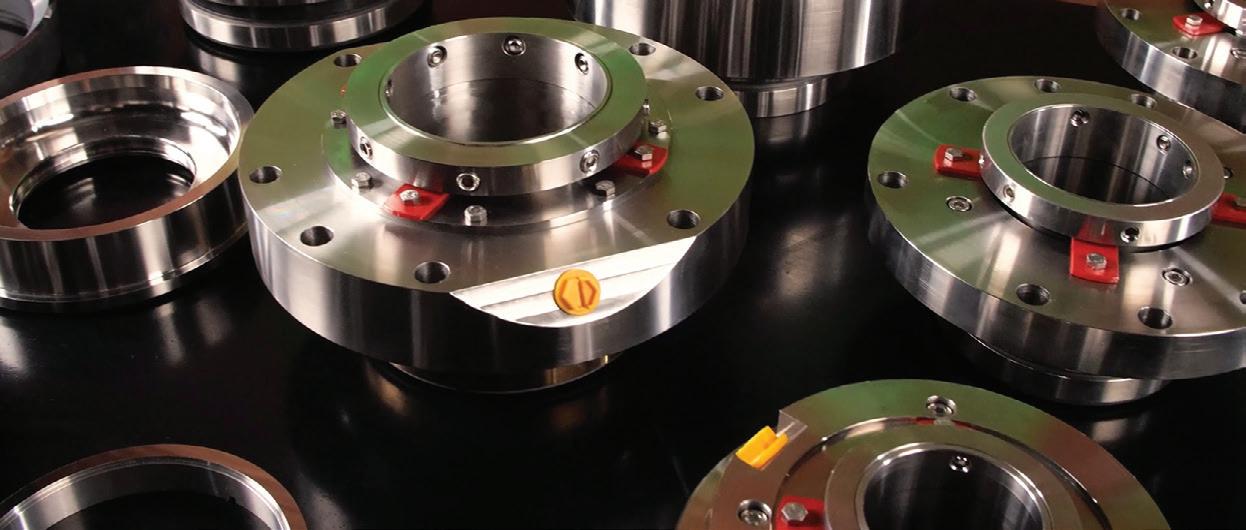

You can install the best pumps in the world, but without good mechanical seals, those pumps won’t last long. Mechanical pump seals prevent fluid leaks, keep contaminants out, and can help save on energy costs by creating less friction on the shaft. Here, we reveal our top five secrets to selecting a good seal, to help ensure pump longevity.

1. Supply – Go local

The global mechanical seals market size is projected to reach US$4.77 billion by 2026, with the highest market growth expected in Asia-Pacific. Australian supplier, Mechanical Seal Engineering, has had to open a new location in Western Australia to support this growth, with the established business offering a large range of pump-specific, component and cartridge seals, as well as refurbishment and repair services and technical advice.

Some of the world’s best seal solutions are indeed right here on your doorstep!

Avoid the current global supply chain and freight delay issues by sourcing your high-quality, cost-effective seals locally.

An initial pressure test, combined with stringent quality control checks, should be undertaken on every seal before you receive them, prior to pump installation. You may otherwise find yourself wasting precious time uninstalling and disassembling your pump to remove a faulty seal. Repairing pumps as soon as faults are suspected is also critical. Quick action is vital to operations, and to the associated cost.

To guarantee high-quality, effective pump performance from the start, ensure your seal supplier has the proper pressure testing facilities and a proven commitment to quality control. In addition, find a trusted supplier who will support you across the whole pump seal’s lifecycle – offering much more than just the product. And check waitlists for repairs – sometimes an issue can’t afford to wait.

If you’re looking to optimise your operating conditions, seek authentic technical advice on material selection, stuffing box piping plans, design problems, etc.

Remember – anyone can pose as an expert and ultimately rip you off! Do your research on those offering advice. Approach an established mechanical pump seal provider and ask questions to help ensure the advice they’re giving is solid, and theirs to give.

A supplier who offers up free knowledge and education is one who is comfortable in demonstrating their understanding and capabilities. Check supplier websites to see if they offer useful tutorials, blogs, case studies, and if they’re authentic in their approach.

There are several possible causes of pump seal failure –improper installation, excess pressure, lack of fluids. You may be tempted to self diagnose the cause, but to ensure best practice and minimise cost, it’s recommended you appoint an expert to analyse the issue and determine how to best rectify it.

Did you know you can request a seal failure report from your seal supplier? Such reports can help improve the productivity and long-term reliability of your seals, minimising potential breakdowns and downtime, and maximising operational efficiency. If your supplier isn’t willing to share failure reports, ask yourself what it is they may be hiding.

5. Customer service – About the people

Customer service can make or break a business. Your pump supplier should know your business as well as their own, and should genuinely want your business to succeed as much as you do.

Select a supplier who can provide a genuine end-to-end service – one who also installs, tests, manages, refurbishes, repairs, converts, reports, advises, understands. A partner in pump seals. Someone you can trust to help keep your pumps operating at their best across their lifecycle.

An Australian-owned business based in SA and WA, Mechanical Seal Engineering is dedicated to providing the best seal services across Australia. We deliver holistic pump seal services to a wide range of industries, keeping it all about our customers – the people. Contact us today for a non-obligatory chat to find out more about the local, reliable seal solutions available to you: 0448 440 612 | sales@mechsealengineering.com.au.

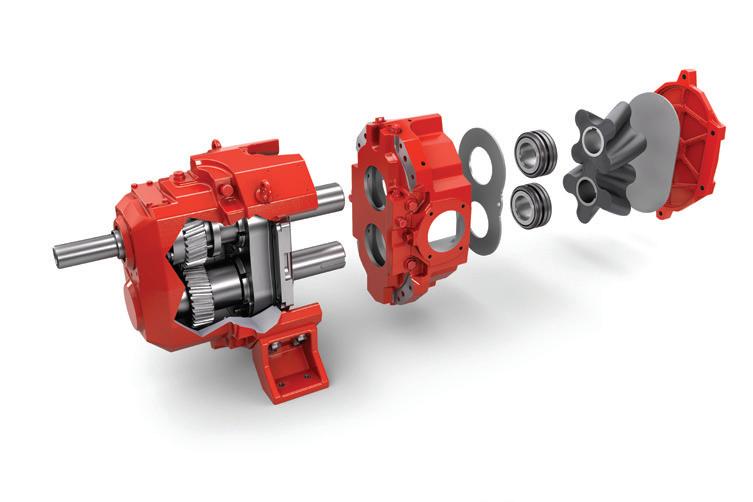

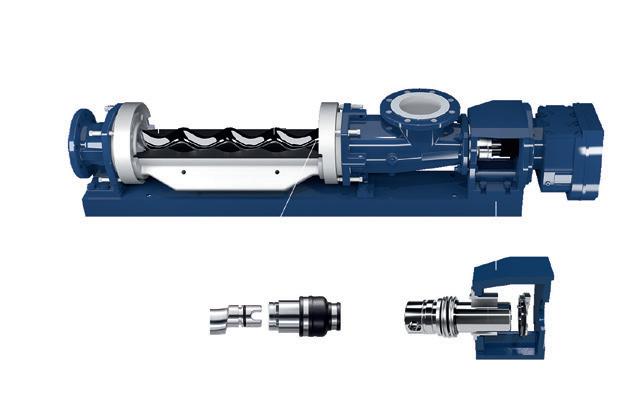

With its EP series and VY series, Vogelsang GmbH & Co. KG from Essen (Oldenburg), Germany, is launching two new pump series that meet the high demands of industrial use. The rotary lobe pumps are made of a flow-optimised one-piece housing and are therefore particularly efficient. They reliably convey thin-bodied as well as highly viscous, pure and solids-containing media at temperatures of up to 200°C. The pumps are ATEX and TA-Luft compliant and thus suited for use in highly demanding areas such as the oil, gas and chemical industries.

TThe high-pressure performance and temperature limit of 200°C along with its seal versatility make the EP series suitable for applications for which companies previously used screw, gear and progressing cavity pumps. These include the oil and gas sector, tank farms, the petrochemical industry, and the production of paints and varnishes, paper, glue and sugar.

Vogelsang has additionally equipped its EP series with an AirGap for increased operational reliability. This gap atmospherically separates the gearbox and the pump chamber, ensuring that in the event of a leak, liquid will drain out rather than entering the gearbox.

hanks to increased efficiency and added seal versatility, Vogelsang is able to open up new areas of application for its proven pump technology. As the inventor of the elastomer-coated rotary lobe pump in 1970, Vogelsang has been for decades one of the world's leading companies in the field of pumps.

EP series: rotary lobe pumps with up to 18 bar pressure

The EP series is designed for extreme conditions and permanently high pressures. Its high-performance gearbox allows for a constant pressure output of up to 18 bar, making it unique on the market today. The pumps of the EP series consist of a one-piece housing made from either cast iron or stainless steel. Helical gears in the gearbox ensure smooth performance and reduce noise emissions. Pulsationfree transferring reduces wear on the adjacent pipeline to a minimum.

The performance spectrum of the VY series ranges from 1m³/h to 120m³/h at a maximum pressure of 10 bar.

VY series: a highly efficient all-rounder

VY series rotary lobe pumps are based on Vogelsang's proven VX series. The versatility of the VY series makes it suitable for use in the chemical industry, as well as in the paper sector. The performance spectrum ranges from 1m³/h to 120m³/h at a maximum pressure of 10 bar. Integrated sensors provide all important information about

Exploded view EP series: The helical high-performance gearbox allows pressures of up to 18 bar.

the pump's operating status. The VY series is also available with axial and radial wear protection for media with abrasive components.

Seal versatility for increased flexibility

A variety of different sealing systems can be used in the housing of the new pump series depending on the industryspecific standard and requirement. In addition to the Vogelsang QualityCartridge, further special mechanical seals are available for the EP and VY series. Vogelsang worked with leading manufacturers to develop the CoXCartridge and offer the right solution for a variety of applications; from use in oil and sugar production, to conveying hot, chemically demanding media or latex paints. The seal's robust design also makes it suited for high-pressure use. The new pump series can also be equipped with mechanical seals according to API 682 if required.

Service-friendly assembly and cleaning

For increased ease of service, both pump series feature a quick connection. Thanks to this, pipelines can be connected to pumps in a matter of minutes. The Quick-Service cover allows access to all internal components. Furthermore, when designing the EP and VY series pumps, the engineers placed significant importance on easy cleaning. The pumps can be rinsed and disinfected according to the CIP (Cleaning in Place) and SIP (Sterilisation in Place) cleaning procedures. The housing design also reduces dead space to a minimum, thus preventing liquids from accumulating in gaps or uneven surfaces.

In everything we do, we never lose sight of what is more important to our customers: to work economically with a technology that is modern, innovative and reliable.

In everything we do, we never lose sight of what is more important to our customers: to work economically with a technology that is modern, innovative and reliable.

As the inventor of the elastomer-coated rotary lobe pump and innovation driver in the field of pumping, grinding and disintegration technology, Vogelsang has been one of the world’s leading mechanical engineering companies for decades. With progressive concepts and sophisticated technology, such as the RotaCut macerator or the wastewater twinshaft grinder XRipper, we work daily on efficient solutions for the individual applications of our customers.

As the inventor of the elastomer-coated rotary lobe pump and innovation driver in the field of pumping, grinding and disintegration technology, Vogelsang has been one of the world’s leading mechanical engineering companies for decades. With progressive concepts and sophisticated technology, such as the RotaCut macerator or the wastewater twinshaft grinder XRipper, we work daily on efficient solutions for the individual applications of our customers.

We use our extensive know-how, the continuous further development of our technical solutions and our many years of experience in the field of environmental technology to support our customers as a competent partner. Among other things, with powerful and service-friendly technology. You can rely on competent and personal advice and reliable service.

We use our extensive know-how, the continuous further development of our technical solutions and our many years of experience in the field of environmental technology to support our customers as a competent partner. Among other things, with powerful and service-friendly technology. You can rely on competent and personal advice and reliable service.

VOGELSANG – LEADING IN TECHNOLOGY

VOGELSANG – LEADING

Unit 2/7 Dunn Road | Smeaton Grange NSW 2567 | Australia

Unit 2/7 Dunn Road | Smeaton Grange NSW 2567 | Australia

Phone: +61 2 4647 8511 | E-mail: sales.au@vogelsang.info vogelsang.info

Phone: +61 2 4647 8511 | E-mail: sales.au@vogelsang.info vogelsang.info

Commencing back in 1962 in Dandenong, Victoria, close-by its present site, Franklin Electric began importing and distributing 4” submersible products. Soon after, local manufacturing commenced with specialised imported parts to offer the Australian water industry Franklin’s world-leading 4” submersible motors.

Over the decades, Franklin Electric motor products were designed and evolved to provide the industry with the highest quality 4”, 6”, 8”, 10” and 12” submersible motor products available.

Quality, reliability and performance

The main benefit that the Australian industry has come to rely on from Franklin is its quality, reliability and performance. Franklin demonstrates these every day to its customers through its Five Key Factors for Success: quality, availability, service, innovation and cost.

Franklin submersible motor products became Australia’s leading submersible motor and indeed the world’s most installed submersible electric motors.

Franklin had been partnering with pump manufacturers for decades and had developed a deep understanding of the market. When the industry started to consolidate around the world in the late 1990s and early 2000s, Franklin had some serious decisions to make.

In 2004, Franklin Electric announced the purchase of JBD (the former Jacuzzi industrial range), and that it was entering the pumping industry by launching Franklin Pumping Systems, now known as FPS. Starting from a very low share, FPS is now leading the US market.

As the pumping industry is global, similar issues applied in Australia. In late 2007, Franklin Electric Australia, after three years of evaluating the market, entered the main water pump industry by launching and distributing its FPS range of submersible pumps and above ground pumps, motors, drives and controls direct to its own Australian dealer network.

In 2005, Franklin Electric purchased a 35 per cent stake of Pioneer Pump Inc, situated in Canby, Portland, Oregon. Pioneer manufactures a large range of centrifugal pumps and automatic self-priming pumps, as well as solids handling selfpriming pumps.

Outside of the US, Pioneer Pump has factories for fabrication, and assembly and warehousing facilities operational in South Africa, England and Australia.

In 2011, Franklin Electric agreed to purchase the remaining 65 per cent of Pioneer. In 2020, Franklin Electric decided to consolidate its water business group globally under one Franklin Electric company.

Today, Franklin Electric Australia and Pioneer Pump Holdings Australia are one company, Franklin Electric Australia New Zealand Pty Ltd, with two facilities operating: the warehouse and assembly facility in Dandenong South, Victoria; and the fabrication assembly and test facility in Sunshine West, Victoria, which includes a logistic warehouse in Ravenhall, Victoria.

Along with the consolidation of the businesses comes the staff and the years of pump experience, the company has hundreds of years of experience to assist every person who needs help with a pump or application.

Today, the range of products have expanded to:

• A full range of surface mount pumps, ISO, split case, multistage, small and large centrifugal motor pumps, progressive cavity (MONO TYPE) and self-priming ranges, small volume low head, to extreme high volumes (2500 LPS) and discharge heads exceeding 300m

• Solar pumps and pumping equipment

• A huge range of belowground pumps: submersible turbine, line shaft, bore hole and dewatering

Truly one of the largest and most comprehensive ranges of pumping and associated products supplied by a single company globally.

“Moving Water Moving Forward”

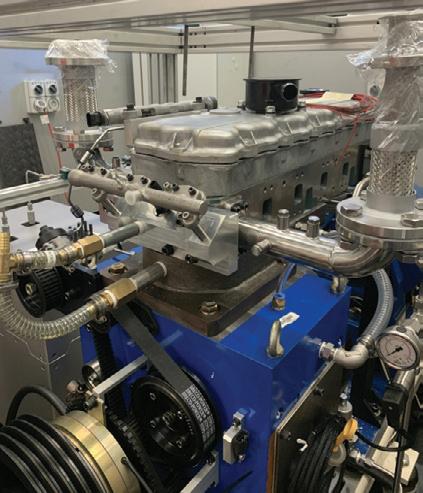

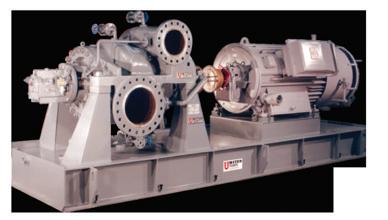

United Pumps designs and manufactures pumps, our extensive Melbourne testing facility is utilized for product development, new pump test and customer pump testing. 2.5Mw capacity with NPSHr capability.

United have made a commitment to API610 pump manufacture in Australia. With decades of experience, we can provide you with the finest engineered equipment and support

Our extensive range of process and water pumps are available in materials to suit your application. With all design and manufacture carried out in Australia we can offer a true Sovereign solution.

Proven track record in municipal water applications over a wide range of the highest quality pumping equipment. Horizontal Split Case, Vertical Turbine, End Suction and Sewage.

They say good things come in tens: ten fingers, ten toes, ten drummers drumming and ten years of Pump Industry Magazine’s State of the Industry report. With the report hitting its double digit birthday, it’s important to reflect on not only the year that was and the year that will be, but the past few years that have gotten the industry to where it is today.

After its enormous global impact over the past few years, 2022 saw the COVID-19 outlook looking up, with the third and fourth vaccine shot made available to the public, the absence of lockdowns, and the long-awaited reopening of Australia’s international border to vaccinated tourists.

In spite of this, Australia and the industry continued to feel the aftershocks of COVID-19, with new variants emerging that delayed international travel’s return, and continuing strict lockdowns in China impacting the global supply chain.

Climate change has been making itself known over the past few years, and none more so than 2022, when climate change was thrust into the global spotlight for the devastating effects it was having around the world.

Over the last 12 months, Australia registered its hottest ever temperature on record, Sydney had its wettest start to the year since records began, and Australia’s south east coast was lashed by the third La Nina weather event in as many years, with flooding affecting farming and bore pump sectors for businesses.

The trend of positive thinking for the year ahead that has emerged over the past few years continued in the latest State of the Industry survey, with many in the pump industry seemingly standing on firmer ground and looking towards 2023 slightly more confident and cautiously optimistic than previous years.

The overarching take away from the latest State of the Industry report is that the events of the last 12 months have not dampened industry spirits, with an overwhelming number of respondents seeing 2023 as brimming with opportunity, and the perfect chance to grow businesses and make headway on projects that have been delayed by COVID-19 over the past few years.

an increase in respondents who are uncertain about the year ahead, rising from last year’s 0.88 per cent.

Concurrent with the increase in positivity for 2023, is the percentage of respondents who have reported a negative outlook for the year ahead, which has also increased, growing from 0.88 per cent last year to the most recent figure of 6.25 per cent.

Despite this increase in negative outlook, the current percentage is still lower than it was during the throes of COVID-19 in 2020 and 2021.

Although there appears to be plenty of factors that could contribute to the overwhelmingly positive outlook for 2023, some of the things that may have contributed to the increase in negative outlooks for the year ahead is the ongoing effects of climate change, the fluctuations of the Australian dollar, inflation, and the uncertainty and effects borne from the Ukraine-Russia war.

Evaluating company performance for 2022

As is visible in Figure 1, a record-breaking majority of respondents reported possessing a positive outlook for their company in 2023 – 87.5 per cent to be exact – a slight increase from the 84.07 per cent of the previous year and a noteworthy jump from the 2021 and 2020 surveys, which indicated 69.56 and 68.25 per cent respectively.

This overwhelming majority could be attributed to the belief that the worst was over in terms of the pandemic.

On equal footing, at 3.13 per cent, is the percentage of respondents who noted either a neutral outlook for the year ahead and those who indicated that they were uncertain.

The figure for respondents with a neutral outlook is down significantly from last year – perhaps due in part to individuals feeling confident and secure enough to adopt a stronger opinion on 2023 and what it holds. This comes contrary to

The performance of their company over the past year likely heavily influenced whether respondents indicated expectations for company performance when looking towards the next year.

Although 2022 was plagued by the Ukraine-Russia war, unprecedented weather events and the ongoing effects of COVID-19, only 6.25 per cent of survey respondents (Figure 2) indicated that the performance of their company had fallen short of expectations for the year.

This number is in line with the decreasing trend of company performance falling short of expectations, down from 14.16 per cent in 2021 and 2020’s 42.75 per cent.

Although some companies have learned to adapt to the new COVID-19 ‘normal’, there are still respondents who are yet to fully experience the light at the end of the pandemic tunnel, especially in locations affected by La Nina.

One respondent said “weather and COVID held up projects” when providing a reason for company performance falling short, with another respondent noting “too many suppliers, not enough customers and low pricing” as the cause for their company not meeting expectations.

The remaining number of respondents were split 50/50 – with 46.88 per cent apiece saying their company’s performance over the last year either met or exceeded expectations.

Those that indicated that their company met expectations listed “strong sales figures around the country”, “company ownership changes, some personnel changes, refocusing on core business opportunities” and “new development happened successfully” as some of the reasons expectations were met.

Multiple respondents have attributed their company meeting expectations to thorough preparation, with one respondent saying “previous excellent pre-planning and preparedness for material and components supply chain issues” was a key factor, and another saying their company “planned for positive growth and achieved it”.

Although the most recent figure of businesses who met expectations has reduced from 2021’s 57.52 per cent and 32.61 percent in 2020, this may not be a bad thing and instead may be due to the significant increase in businesses who exceeded their performance expectation, growing from 28.32 per cent in 2021 (Figure 2).

This can likely be attributed to the continued utilisation of COVID strategies and coping mechanisms, with companies now well-adjusted and accustomed to operating in a postpandemic world, learning to adapt and accommodate for supply chain disturbances, filling gaps in the market, and turning their focus to increasing their company name within Australia.

Several respondents indicated that a backlog from previous COVID delays has caused their company performance to exceed expectations, with one respondent noting “COVID delayed many projects and tender decisions” but “over the past six to eight months [we] have experienced a progressive improvement”.

Another respondent said, “Our order book has grown significantly – this is partially due to the delays in shipping resulting in delays in building and supplying pushing us back in the first quarter 22.”

Additionally, multiple respondents simply said “more sales” was the area that pushed companies to exceed expectations, with one respondent pinpointing that “demand has exploded” and another saying “strong project sales” had a huge impact.

Another respondent noted that for some companies to exceed expectations, it was as easy as returning to the basics; in other words “great product, great customer service, good delivery times, growing brand awareness in Australia”.

The outlook for the pump industry in 2023

Unsurprisingly, respondents’ feelings about whether or not 2023 would be a good year was influenced by their company’s performance over the past year, among other things.

Although the State of the Industry respondents had shown an overwhelming sense of positivity in regards to company outlook for 2023, there was less positivity towards the future of the pump industry as a whole in 2023, with only 62.5 per cent adopting a positive mindset for the year ahead (Figure 3).

This is a minute decrease from 2021’s 62.83 per cent, but still higher than the percentages of years 2020, 2019 and 2018.

The percentage of people with a negative attitude towards the pump industry’s 2023 grew from 0.88 per cent in 2021 to the current recent figure of 3.13 per cent.

Despite the increase in those with a negative outlook, the percentage is still lower than it was during the years of strict COVID lockdowns. This could be indicative of new issues companies have begun facing instead of the knock on effects of COVID-19, including inflation, the unprecedented natural disasters, and the Ukraine-Russia war.

The percentage of respondents with a neutral outlook towards the pump industry in 2023 is 31.25 per cent – the highest it’s been since 2020. On the other hand, the percentage of people with an uncertain outlook for 2023 sits at 3.13 per cent, a significant decrease from 2021’s 19.47 per cent and the lowest figure of the last four years.

This indicates that a great deal of the uncertainty that companies faced due to the pandemic has vanished, with companies instead gauging the future based on 2022 performances and other factors to draw their own conclusions about what may come in the year ahead.

In order to determine how key verticals are expected to perform in the year ahead, it is essential to analyse and understand sector performance throughout the last year.

Survey respondents were asked to provide details about the volume of work experienced over key verticals – including mining, water and wastewater, and irrigation – over the last 12 months.

These results were then compared alongside the responses gathered from last year’s State of the Industry.

It’s important to keep in mind that at the time industry sector predictions were made for 2022, optimism for COVID-19 recovery was buoyed by the rollout of vaccines, the approval of a booster vaccine for COVID-19, as well as the planned announcement that fully vaccinated Australian citizens and permanent residents would be able to leave Australia without needing an outwards travel exemption.

With all of this influential progress, survey respondents expected that performance in all industry sectors would grow, with the largest increases expected for water and wastewater, mining, and irrigation – all of which were slated to increase or increase significantly.

As depicted in Figure 4, except for plastics and rubber, all of the performance figures reported for 2022 fell short of expectations.

Water and wastewater was the highest performing sector over the last 12 months according to respondents, a result that is in line with survey respondents’ predictions.

Other front-runners included mining – also predicted by respondents – and food and beverage, a surprising result when compared to respondents’ expectations and especially when compared to 2021 performance, which saw food and beverage performance decrease.

The worst performing sectors were pulp and paper, plastics and rubber, chemicals and pharmaceuticals, and power generation, with pulp and paper once again prevailing as the worst performing sector, in line with the performance results of 2021.

However, unlike 2021, which saw performance decrease in three industry sectors, 2022 industry sector performance only decreased for pulp and paper – although overall performance for this sector was better in 2022 than 2021.

At Brown Brothers Engineers we have the most comprehensive range of quality pumps and innovative pumping solutions. We are the distributor for some of the world’s leading brands including:

Layne Bowler vertical turbine pumps have a proven record under the most demanding and toughest of conditions.

• Flows to 2,300 L/Sec

• Heads to 350 m

• Power to 1000+ kW

• Temperatures to 150°C

• Bowls Diameter up to 45 inch

When high head and high flows are required look no further than this

• Flows to 5000m³/h

• Head to 220m

• Pumps that exceed EN733 (DIN 24255 standard)

Call us today to see how we can deliver your pumping solution.

Figure 5: How growth across sectors tracked in 2022 compared to recent years, and expectations for 2023.

In Figure 5, the trends of sector performance can be seen over the last few years, with expected performance for 2023 also included.

Continuing on the theme of optimism, respondents expect growth across all sectors for 2023, with water and wastewater once again the predicted front-runner. Other sectors where respondents expect performance growth are irrigation, mining, oil and gas, and – despite not performing as well as expected in 2022 – food and beverage.

Figure 6: Most sectors are expected to perform better in 2023 than they did in 2022.

Sector growth predictions for the year ahead

Due to the diversity of sectors and businesses within the pump industry and across respondents’ businesses, trends and events across the industry affected businesses differently.

Survey respondents were asked to indicate trends, positive or negative, that had impacted their business over the last 12 months, as well as their expected impact over the year ahead.

Many highlighted the investment in new infrastructure as a positive trend, as well as new projects and the uptake of new technologies. Respondents indicated that growth in certain sectors directly relating to businesses – including food and beverage, and water and wastewater – as a positive trend affecting business.

Despite there being some businesses that noted COVID-19 had a positive impact to their business, the overwhelming majority of respondents noted it had a negative impact throughout 2022.

As can be seen in Figure 7, as predicted in the 2022 State of the Industry report, supply chain, freight and pricing issues did linger in 2022, as well as new issues and negative trends arising from global events.

Factors respondents expect to have a negative impact on the industry in 2023 include the value of the Australian dollar, interest rates, commodities prices, and the Ukraine-Russia war and the resulting increase in energy prices.

Closer to home, unsurprisingly, many pinpointed unprecedented weather patterns, including La Nina weather events and the resulting floods as having a significant negative impact on business, which respondents expect to continue into 2023.

Additionally, results indicated that the labour and skill shortage and “lack of qualified human resources” was also having a negative effect on businesses.

Among factors that most respondents expected to have a positive impact were new technologies and innovations, agricultural industry, the performance of the mining industry, and the major projects approved and/or underway.

Russia-Ukraine war continuing to place pressure on LNG prices.

Buyers in Europe are scrambling for uncontracted LNG cargoes to supplement loss following Russia’s interruption of gas flow to Europe, which in turn could result in Asian customers having to compete for available LNG.

Australia’s LNG earnings rely quite heavily on whether or not Russia restores European gas flows – if the LNG flow continues to be reduced, Australia’s earnings will rise.

The La Nina weather systems have battered Australia’s south east coast, producing higher than average rainfall and resulting in extreme flooding in certain areas, with Southern Queensland and northern New South Wales at one point each receiving more than a year’s worth of rainfall in a week.

The effects of the Ukraine-Russia war were felt throughout the world over the course of 2022.

Countries around the world are placing new sanctions on Russia, and the European Union has agreed to a plan to block two thirds of Russia’s oil, resulting in soaring energy prices –for both oil and gas.

Shockwaves were also felt by the global freight logistics system, with rising energy prices resulting in an increase in shipping costs and supply chain delays worldwide.

Global iron ore markets continue to experience fallout from Russia’s invasion of Ukraine, and with Ukraine’s typical supply chains disrupted or blocked by Russian forces, iron ore exports have taken a nosedive in recent months.

As one of the top five exporters of LNG in the world, Australia’s LNG export earnings have risen throughout the year and are expected to continue to rise as a result of the

Many communities and councils around Australia have turned to the pump industry, seeking assistance to mitigate the effects of the floods and as a way to prepare and safeguard against future weather events.

The New South Wales Government committed $145 million in funding for the repair and upgrade of critical water and sewerage infrastructure – including pump stations – damaged by floods across the Northern Rivers area. The works are set to make permanent repairs to damaged infrastructure as well as upgrade to future-proof the critical infrastructure.

Survey respondents indicated that investment in new infrastructure was a positive trend helping businesses thrive during 2022. This infrastructure investment is set to continue into the new year, especially following the 2022-23 Federal Budget, which is set to deliver more than $2 billion to water security and infrastructure projects.

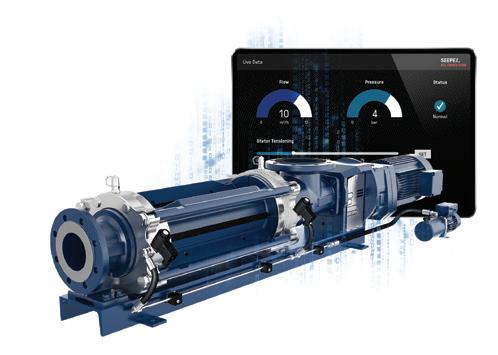

IIoT is opening new doorways for the pump industry as pump operators look to improve the sustainability and efficiency of their systems.

Investment in water security and infrastructure to futureproof water accessibility in the face of population growth and climate change include the following:

• $600 million towards the Paradise Dam Improvement project in Queensland

• $107.5 million towards the Cairns Water Security – Stage 1 project in Queensland

• $3.5 million towards the Mount Morgan Water Supply project in Queensland

• $12.5 million towards groundwater improvement and water efficiency in the lower Burdekin, Queensland

• $11.5 million towards strategic planning for improving water security in Queensland

• $8.0 million in additional funding towards Big Rocks Weir in Queensland

• $100.0 million towards the Pipeline to Prosperity Tranche 3 projects in Tasmania

• $300.6 million towards the Darwin Region Water Supply –Stage 1 in the Northern Territory

• $7.1 million towards the Adelaide River Science project in the Northern Territory

• $23.0 million towards the Nyngan to Cobar Pipeline – Stage 1 in New South Wales

On a state and territory level, New South Wales committed to the biggest spend, pledging a $1.1 billion investment into the state’s water resources to ensure sustainable and secure water in the changing climate. Projects funded include maintaining assets within the Hunter Valley Flood Mitigation Scheme to help minimise flood risk; improving critical water supply infrastructure for the towns of Wilcannia and Cobar; and for its Off-Farm Efficiency Program.

Queensland followed up with a commitment of $510 million for water infrastructure and planning projects to improve water security for the state’s communities and provide economic growth and job opportunities. Projects that received funding include the Toowoomba to Warwick Pipeline; Stage One of the Cairns Water Security program; construction of a drinking water pipeline from Gracemere to Mt Morgan; and the development of Flinders Shire Council’s Hughenden Water Bank project.

Victoria pledged $112 million to manage water sustainably into the future – maintaining green spaces, supporting farmers, and securing the drinking water supply.

The critical skills and labour shortage

Despite Australia's international borders reopening to welcome visa holders, respondents have flagged the labour and skills shortage as something that has negatively impacted the industry.